Eupraxia Pharmaceuticals Inc. (EPRX) – Investment Snapshot

Stock Price: US$5.40 | Market Cap: ~US$194M

Recommendation: Buy | Target Price: US$12.00

On July 8, 2025, Eupraxia Pharmaceuticals Inc. (NASDAQ: EPRX, TSX: EPRX) announced a significant milestone in its clinical development program, dosing the first patient in the placebo-controlled Phase 2b portion of the RESOLVE trial for eosinophilic esophagitis (EoE) with its investigational therapy, EP-104GI. This press release marks a pivotal transition from the open-label, dose-escalation Phase 2a study to a randomized, controlled Phase 2b trial, a critical step toward pivotal trials required for regulatory approval. The announcement reinforces our Buy recommendation and $12.00 price target, driven by promising early data and the innovative approach of EP-104GI.

Key Highlights from July 8, 2025, press release

Eupraxia’s proprietary DiffuSphere™ technology underpins EP-104GI, delivering fluticasone directly into the esophageal tissue to reduce inflammation with stable, localized, and long-duration drug release. This approach minimizes systemic side effects commonly associated with steroid-based therapies, such as oral or gastrointestinal candidiasis, adrenal suppression, or glucose derangement. The Phase 2b trial builds on encouraging data from the Phase 2a study, particularly from Cohort 8, which informed the selection of the 120mg dose (20 injections of 6mg per site) as the first active arm. A second active dose will be chosen after further data analysis.

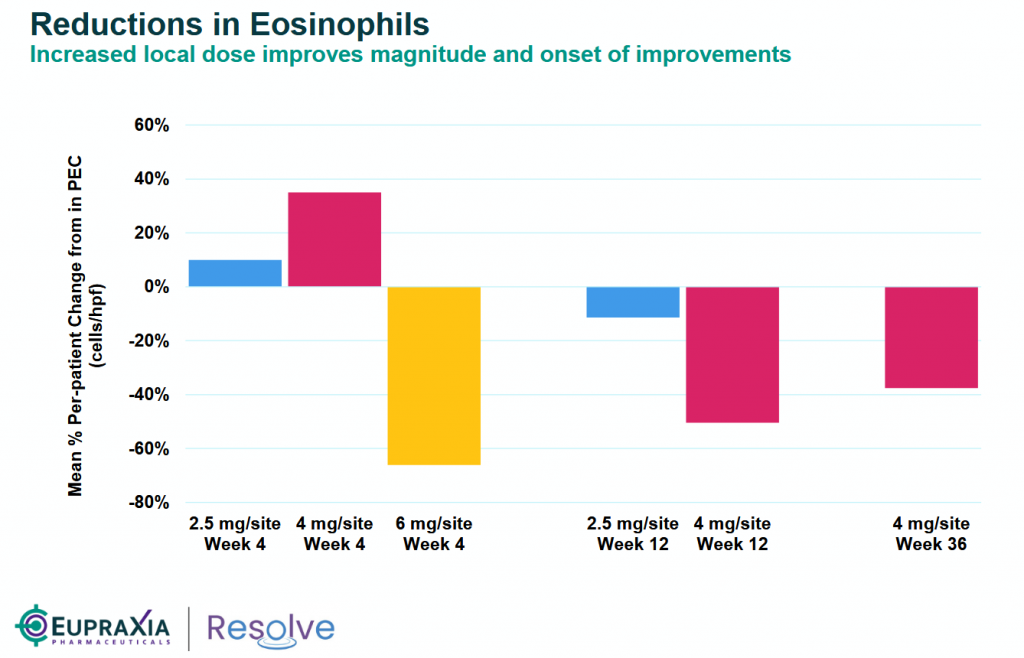

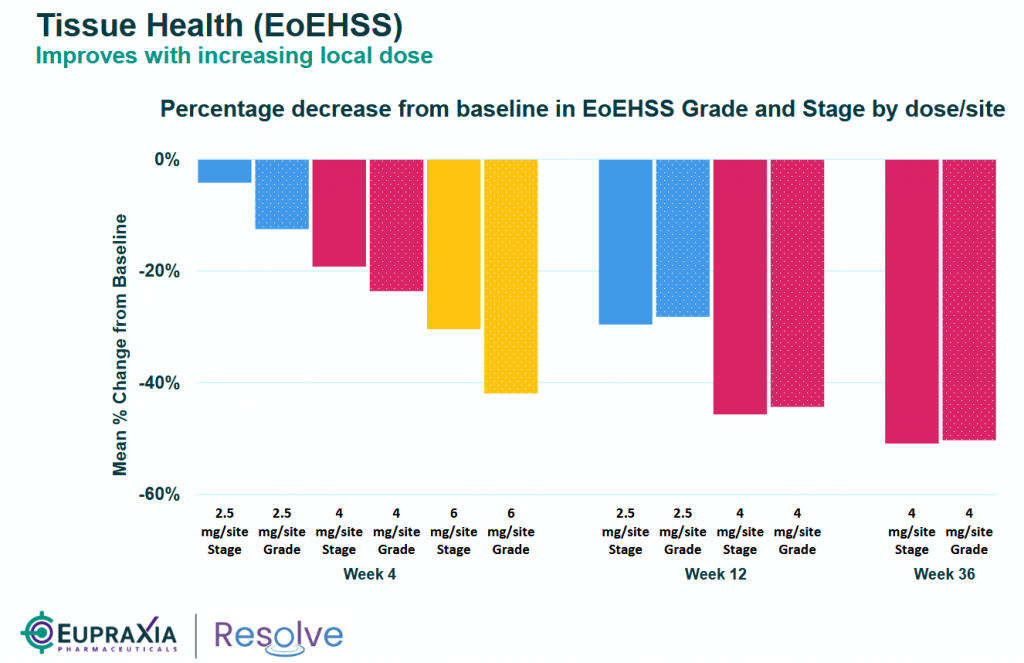

The press release highlights the selection of the 120mg dose based on a comprehensive review of safety, pharmacokinetic, and efficacy data from Cohorts 1–8 of the Phase 2a study. Notably, Cohort 8 demonstrated the largest and earliest decline in Peak Eosinophil Count (PEC) and the lowest Eosinophilic Esophagitis Histology Scoring System (EoEHSS) scores at four weeks compared to prior cohorts (as detailed in the attached slides). The RESOLVE Safety Review Committee’s approval of this dose underscores its favorable tolerability profile.

And a deeper look at the tissue health – EoEHSS show an impressive mean % change from baseline in the 6mg dose at a very early stage (Week 4) versus 4mg dose or lower.

Source: July Corporate Presentation

Phase 2b Trial Design

The Phase 2b portion of the RESOLVE trial is a multicenter, randomized, placebo-controlled study enrolling at least 60 patients across up to 25 global sites in a 1:1:1 ratio across three arms: two active doses of EP-104GI and one placebo. The trial will evaluate:

- Tissue Health: Assessed via EoEHSS and PEC, measuring histological changes in esophageal biopsies.

- Symptom Improvement: Evaluated using patient-reported outcomes, including the Straumann Dysphagia Index (SDI) and Dysphagia Symptom Questionnaire (DSQ).

- Endoscopic and Histologic Outcomes: Including reductions in PEC.

- Pharmacokinetics, Safety, and Tolerability: Over a 12-month period, with assessments at 12, 24, 36, and 52 weeks.

Eligible placebo patients may switch to active treatment after six months. Topline data are expected in Q3 2026, with ongoing Phase 2a data updates, including 12-week Cohort 8 results, anticipated in Q3 2025. The adaptive design allows for dose optimization based on emerging data, enhancing the trial’s flexibility.

Contextual Insights from Prior RESOLVE Trial Data

The Phase 2a open-label, dose-escalation study (Cohorts 1–8) has provided robust evidence supporting EP-104GI’s potential. Key findings include:

- Cohort 6 (64mg, 16 injections of 4mg): Showed the greatest symptom relief (SDI) and tissue health improvements (EoEHSS) at 12 weeks, with an 83% mean reduction in PEC, indicating a clear dose-response trend from Cohorts 3–6.

- Cohort 5 (48mg, 12 injections of 4mg): Demonstrated the largest SDI reduction at 24 weeks, with one patient achieving complete histological remission (fewer than six eosinophils per high-powered field).

- Cohorts 1–4: Showed consistent symptom improvement, with 10 of 11 evaluable patients reporting reduced SDI scores at 12 weeks and a 67% mean PEC reduction in Cohort 4. Sustained efficacy was observed up to 24 weeks in earlier cohorts, with Cohort 1 showing benefits up to six months at a low dose (4mg).

- Safety Profile: No serious adverse events, candidiasis, or changes in cortisol or glucose levels were reported across Cohorts 1–6, with Cohort 7 fully enrolled and 12-week data expected in Q3 2025. Low plasma fluticasone levels support higher dosing without systemic effects.

Remarkably, a May 2025 update reported sustained or improved outcomes at nine months in some patients, an unprecedented result for an injectable EoE therapy, highlighting the durability of DiffuSphere™ technology.

Investment Outlook and Broader Context

EoE, an inflammatory condition affecting over 500,000 people in the U.S. with rapid growth in US prevalence of disease to around one million in 2026, causes pain and difficulty swallowing, with current treatments like oral budesonide (Jorveza/Ortikos) or dupilumab (Dupixent) often limited by frequent dosing, poor control, or side effects. EP-104GI’s localized delivery and potential for once-yearly dosing could position it as a best-in-class therapy, addressing a significant unmet need. The American Gastroenterological Association notes EoE’s rising incidence, underscoring the market opportunity.

The 120mg dose selection for Phase 2b, informed by Cohort 8’s strong early efficacy and safety, suggests EP-104GI could outperform existing therapies, particularly if higher doses maintain the favorable safety-efficacy balance seen in lower-dose cohorts. Fluticasone’s proven efficacy, combined with Eupraxia’s innovative delivery, supports our thesis of robust outcomes in larger trials.

Upcoming catalysts include 12-week Cohort 8, and important 36 weeks of Cohort 6, where they will have both PEC and EoEHSS data as well from biopsy taken on 9-months point, and finally the full year data from Cohort 5 (Q3-2025), with further Phase 2a updates expected in September and December 2025. While Phase 2b topline results are expected in Q3-2026

Eupraxia’s broader pipeline, including EP-104IAR for knee osteoarthritis (which met its primary endpoint in a Phase 2b trial), strengthens its position as a leader in precision drug delivery. With a cash runway to Q3 2026, EPRX is well-funded to advance its programs. We view the stock as undervalued, with significant upside potential as clinical milestones approach.

Note: Investors should review Eupraxia’s website (www.eupraxiapharma.com) and the July 8, 2025, press release (available at https://eupraxiapharma.com/news/news-details/2025/Eupraxia-Doses-First-Patient-in-Phase-2b-Placebo-Controlled-Portion-of-EP-104GI-RESOLVE-Trial-in-Eosinophilic-Esophagitis/default.aspx) for additional details, including the July 2025 corporate presentation.”

Disclosure: The author holds a long position in EPRX in both the Canadian and U.S. markets.