Eupraxia Pharmaceuticals Inc. (EPRX) – Investment Snapshot

Date: August 20, 2025

Stock Price: US$5.39 | Market Cap: US$193M (as of 8/19/2025 close)

Recommendation: Buy | Target Price: $12.00

On August 19, 2025, Celldex Therapeutics (CLDX) announced results from its Phase 2 trial of barzolvolimab in EoE. The monoclonal antibody (mAb) targeting KIT met its primary endpoint with profound mast cell depletion (p < 0.0001) but failed to show meaningful improvements in symptoms (Dysphagia Symptom Questionnaire, DSQ; p=0.33), endoscopic changes (Esophageal Reference Score, EREFS; p=0.95), or eosinophil reduction (p=0.57). Celldex will not advance the drug in EoE, citing limited clinical benefit despite biological activity.

This reinforces our view that targeted biologics struggle with EoE’s multifaceted pathology, where multiple inflammatory pathways (e.g., eosinophils, mast cells, IL-13) must be addressed comprehensively. Safely delivered steroids with favorable pharmacokinetics and sustained duration, like EPRX’s EP-104GI, may offer a simpler, more effective upstream solution.

This outcome aligns with a pattern of challenges for systemic biologics in EoE, thinning the competitive landscape and highlighting the unmet need for durable, localized therapies.

EoE, an inflammatory condition affecting over 500,000 people in the U.S. with rapid growth in US prevalence of disease to around one million in 2026, causes pain and difficulty swallowing, with current treatments like oral budesonide (Jorveza/Ortikos) or dupilumab (Dupixent) often limited by frequent dosing, poor control, or side effects. EP-104GI’s localized delivery and potential for once-yearly dosing could position it as a best-in-class therapy, addressing a significant unmet need. The American Gastroenterological Association notes EoE’s rising incidence, underscoring the market opportunity.

Key Highlights from CLDX and Broader Biologic Failures

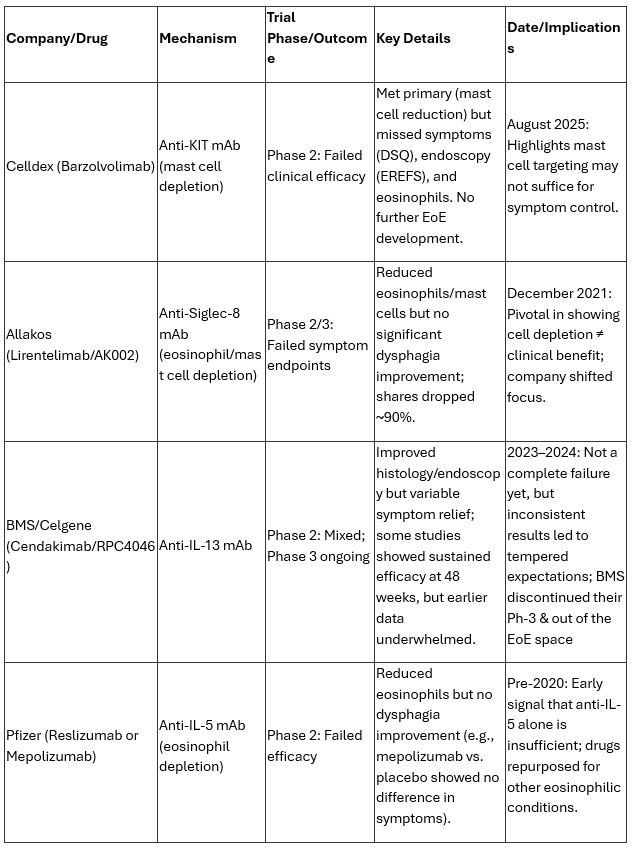

Looking back in the history of EoE trials, this follows similar disappointments from Allakos, Bristol-Myers Squibb (BMY & Celgene), and Pfizer. These failures underscore the difficulty in targeting specific cytokines or cells systemically while achieving broad clinical benefits. Here’s a comparison of key failed or mixed biologic trials in EoE:

These biologics often succeed in reducing eosinophils or mast cells but fail on patient-reported outcomes like dysphagia, which are crucial for FDA approval in EoE. In contrast, dupilumab (Sanofi/Regeneron, an anti-IL-4/13 mAb) is the only approved biologic for EoE (since 2022), showing consistent symptoms and histologic improvements, though it requires weekly injections and has systemic side effects like conjunctivitis, underscore the appeal of EP-104GI’s once-annual injection, potentially timed with patients’ annual endoscopies for convenience.

Thoughts on Implications for Eupraxia Pharmaceuticals (EPRX)

The CLDX failure, combined with prior setbacks, is net positive for EPRX in my view, as it further limits the competitive landscape for systemic biologics while highlighting the need for differentiated, localized therapies like EP-104GI. EPRX’s approach isn’t a biologic, it’s an injectable, extended-release formulation of fluticasone (a corticosteroid) using proprietary DiffuSphere™ technology for direct esophageal delivery, aiming for once-yearly dosing with minimal systemic exposure. This contrasts sharply with the systemic mAbs that have struggled:

- Reduced Competition: With fewer viable biologic candidates, the EoE market (estimated at ~500,000 U.S. patients, potentially growing to around one million by 2026 per rising incidence trends) remains underserved. Approved options like dupilumab (frequent dosing) or topical steroids (daily use, poor adherence) leave room for EPRX’s convenient, targeted therapy. Failures like CLDX’s reinforce that depleting specific cells systemically may not address the full EoE pathology (e.g., fibrosis, remodeling), where localized anti-inflammatory effects could shine.

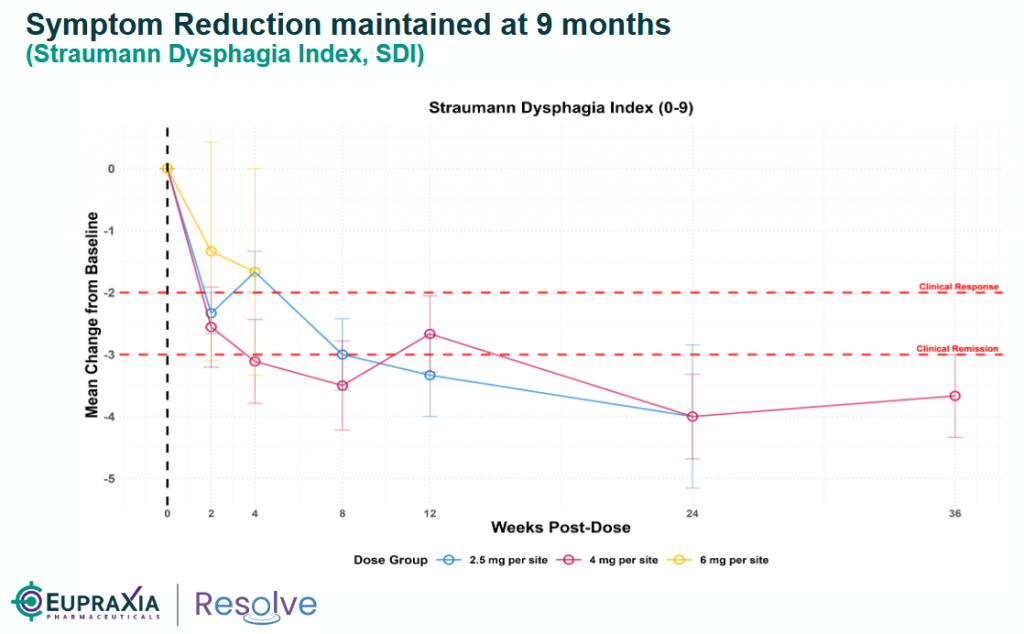

- Validation of Localized Approach: EPRX’s RESOLVE trial (Phase 2b ongoing, topline in Q3 2026) has shown promising early data: Cohort 8 (120mg dose) achieved the largest/earliest reductions in peak eosinophil count (PEC) and EoE Histology Scoring System (EoEHSS) at 4 weeks, with sustained efficacy up to 9–12 months in earlier cohorts and no serious adverse events. This suggests EP-104GI could offer durable symptom relief (via SDI/DSQ) and histologic benefits without the systemic risks of biologics. The failures emphasize that EoE may respond better to broad, localized suppression of inflammation rather than narrow cytokine targeting.

source: Eupraxia’s corporate presentation

- Potential Risks/Considerations: While positive, EoE trials are notoriously challenging due to placebo effects and variable symptom reporting. EPRX must demonstrate clear symptom improvement in the newly initiated Phase 2b to avoid similar pitfalls. Steroids like fluticasone have known risks (e.g., candidiasis), but EPRX’s localized delivery has shown low systemic exposure so far. Market sentiment could be volatile if more biologics fail, but EPRX’s non-biologic profile insulates it.

- Investment Outlook: EPRX (trading at ~US $5.40, market cap $194M as of July 2025) looks increasingly attractive with catalysts like Q3 2025 Cohort 8 data and Q3 2026 topline. The thinned pipeline could accelerate partnerships or buyout interest, especially with EPRX’s broader pipeline (e.g., EP-104IAR for osteoarthritis). I maintain a Buy stance with a $12 target, as these failures underscore EP-104GI’s potential as a best-in-class option in a market projected to exceed $1B by 2030. However, monitor for any EoE-specific regulatory shifts or dupilumab expansions.

EPRX’s RESOLVE Trial: Building Momentum

EP-104GI, an extended-release fluticasone injectable using DiffuSphere™ technology, delivers localized anti-inflammatory effects directly to esophageal tissue, minimizing systemic side effects (e.g., no candidiasis or cortisol/glucose changes reported). Phase 1b/2a data from Cohorts 1–8 show compelling durability: Cohort 5 (48mg, 12 injections) demonstrated active drug release and sustained/improved outcomes at nine months, with a clear dose-response trend (e.g., 83% PEC reduction in Cohort 6). Cohort 8 (120mg) selected for Phase 2b based on strong early PEC/EoEHSS reductions. No serious adverse events to date.

The Phase 2b portion (enrolling ≥60 patients, 1:1:1 randomization to two doses or placebo) evaluates tissue health (EoEHSS, PEC), symptoms (Straumann Dysphagia Index, SDI; DSQ), endoscopy, pharmacokinetics, safety, and tolerability over 12 months. Placebo cross-over at six months; adaptive design for dose optimization.

Upcoming catalysts: Additional Cohort 5–8 data in October 2025, further Phase 2a updates in late 2025, and topline results in 2H26. Positive data could enable a single Phase 3 trial (~150–300 patients, 52-week follow-up) starting early 2027, supporting approval.

Investment Outlook and Valuation

The CLDX failure removes a potential competitor and validates EP-104GI’s approach, as echoed in market commentary positioning EPRX as a potential standard of care due to its upstream MOA addressing multiple pathways via localized precision dosing.

EPRX (trading at ~US $5.40, market cap $194M as of July 2025) looks increasingly attractive with catalysts like Cohort 8 data in October and Q3 2026 topline. The thinned pipeline could accelerate partnerships or buyout interest, especially with EPRX’s broader pipeline (e.g., EP-104IAR for osteoarthritis). I maintain a Buy stance with a $12 target, as these failures underscore EP-104GI’s potential as a best-in-class option in a market projected to exceed $1B by 2030, EPRX remains undervalued. However, monitor for any EoE-specific regulatory shifts or dupilumab expansions.

Risks: 1) Clinical development (e.g., Phase 2b symptom data); 2) Regulatory (FDA alignment on endpoints); 3) Commercial (competition from established treatments like dupilumab or off-label generics); 4) Financing (beyond current runway); 5) Cross-border (Canadian base with U.S. presence; potential tariffs/supply issues).

Note: Investors should review Eupraxia’s website (www.eupraxiapharma.com) and the July 8, 2025, press release (available at https://eupraxiapharma.com/news/news-details/2025/Eupraxia-Doses-First-Patient-in-Phase-2b-Placebo-Controlled-Portion-of-EP-104GI-RESOLVE-Trial-in-Eosinophilic-Esophagitis/default.aspx) for additional details, including the July 2025 corporate presentation.”

Disclosure: The author holds a long position in EPRX in both the Canadian and U.S. markets.