Eupraxia Pharmaceuticals Inc. (EPRX) – Investment Snapshot

Date: September 02, 2025

Stock Price: US$5.48 | Market Cap: US$198M (as of 09/02/2025)

Recommendation: Buy | Target Price: US$12.00

On September 2, 2025, Eupraxia Pharmaceuticals ($EPRX) released one-year results from Cohort 5 (48 mg dose, 12 injections of 4 mg each) of the Phase 1b/2a RESOLVE trial, evaluating EP-104Preview (opens in a new tab)GI, an extended-release fluticasone propionate for eosinophilic esophagitis (EoE). The data reinforces EP-104GI’s potential as a transformative, once-yearly injectable therapy, showcasing sustained clinical and histological benefits.

Key RESOLVE Trial Results (Cohort 5, 52-Week Follow-Up):

- Clinical Remission: 66.7% (2/3 patients) maintained histologic remission (peak eosinophil count ≤6 eosinophils/high-power field [eos/hpf]) at 12 months.

- Symptom Improvement: Sustained reductions and meaningful levels of clinical remission in Straumann Dysphagia Index (SDI) scores, with earlier cohorts showing 78% reductions at 24 weeks (n=9) and 67% at 52 Weeks (n=3).

- Tissue Health: All Cohorts followed to 9 months have maintained clinically meaningful improvements in tissue health as measured by EoE Histological Scoring System (“EoEHSS”)

- Safety: No serious adverse events or candidiasis, a common issue with oral steroids.

- Durability: Single-dose administration provided benefits for up to 12 months, a potential advantage over existing treatments like Dupixent (weekly injections).

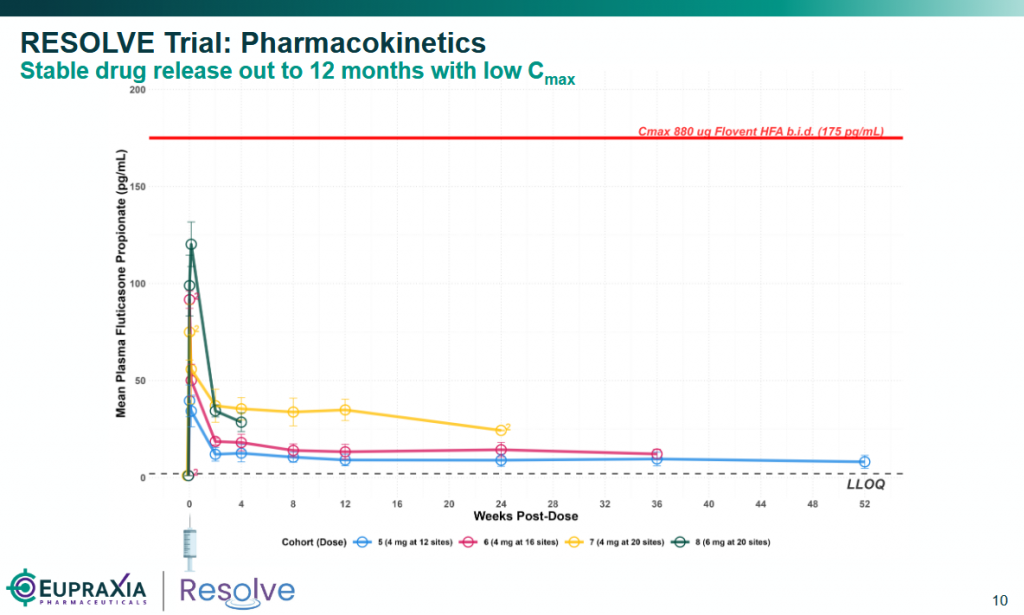

- Pharmacokinetics: Plasma levels of fluticasone in patients treated with 4mg per injection of EP-104GI remained level and predictable out to 52 weeks (see graph below).

This data has generated positive sentiment between investors, highlighting the potential for EP-104GI to become a new standard of care due to its durability and convenience.

Source: Eupraxia’s corporate presentation

Source: Eupraxia’s corporate presentation

Trial Progress and Future Catalysts:

Cohort 5’s results, covering ~60% of the esophagus (48 mg, 4 mg across 12 injection sites), demonstrate robust efficacy. In contrast, Cohort 8 and the ongoing Phase 2b study employ a higher 120 mg dose (6 mg across 20 injection sites) for full esophageal coverage, potentially yielding even stronger outcomes.

The next data release in November 2025 will include 52-week results from Cohort 6 (4 mg across 12 sites), further validating durability. Topline Phase 2b data, expected in Q3 2026, represents a major catalyst.

Dosing Advantage:

- A key focus is likely the single-dose, 12-month durability, a significant differentiator from Dupixent’s weekly injections or budesonide’s daily oral/swallowed administration of steroids. The street may underscore the potential for improved patient compliance and reduced treatment burden, positioning EP-104GI as a transformative option.

- We can see this as a commercially attractive model, especially if aligned with annual endoscopy visits, a win for both patients and payers.

- The drug’s delivery mechanism solves a long-standing challenge with steroid targeting in EoE

Safety Profile:

The absence of serious adverse events and oral or gastrointestinal candidiasis is likely viewed as a major advantage over oral steroids, which carry risks of fungal infections. The street may note the localized delivery of fluticasone via EP-104GI’s DiffuSphere™ technology as reducing systemic side effects compared to systemic biologics like Dupixent.

Market opportunity and Competitive Landscape:

EoE, a chronic inflammatory condition with rising prevalence, represents a $1.8–$2 billion market. Current treatments, including swallowed steroids and biologics like Dupixent, require frequent dosing, creating an unmet need for convenient, long-acting therapies. EP-104GI’s potential to reduce dosing frequency positions it to capture significant market share.

One-Year Chart Overview

EPRX has delivered an impressive performance, and surged 149% over the past year, from a 52-week low of $2.20 to a high of $6.20. Following this strong rally, the stock entered a consolidation phase, forming a classic pennant pattern while consistently closing above its 52-week moving average, which is a bullish technical signal.

Today, the price broke out above the pennant’s upper trendline, indicating renewed upward momentum. The next key resistance level is at $5.58 line, with a potential retest of the 52-week high at $6.20 on the horizon.

Investment Outlook and Valuation

EP-104GI’s one-year durability validates its upstream mechanism of action, delivering localized precision dosing to address multiple EoE pathways.

EPRX (trading at ~US $5.48, market cap $197M as of Sep 02, 2025) looks increasingly attractive given the catalysts like Cohort 6 and 8 data in November and Phase-2b topline in Q3 2026.

The streamlined pipeline, including EP-104IAR for osteoarthritis, could attract partnerships or buyout interest. I maintain a Buy rating with a $12.00 target, reflecting EP-104GI’s best-in-class potential in a market projected to exceed $1 billion by 2030. However, investors should monitor EoE-specific regulatory shifts and competition from Dupixent or generics.

Risks:

- Clinical: Phase 2b symptom data may vary in larger cohorts.

- Regulatory: FDA alignment on endpoints (e.g., histologic vs. symptom-based).

- Commercial: Competition from Dupixent and off-label generics.

- Financing: Cash runway beyond current projections.

Resources: Investors should review Eupraxia’s website (www.eupraxiapharma.com) and the new September 02, 2025, press release (available at https://eupraxiapharma.com/news/news-details/2025/First-Set-of-1-Year-Clinical-Results-from-RESOLVE-Trial-in-Eosinophilic-Esophagitis-EoE-Durable-and-Sustained-Symptom–Tissue-Responses-after-Dosing-with-EP-104GI/default.aspx ) for additional details, including the September 2025 corporate presentation.”

Disclosure: The author holds a long position in EPRX in both the Canadian and U.S. markets.