Chimera Research Group

Critical Minerals Equity Note

LibertyStream Infrastructure Partners Inc. (TSXV: LIB | OTCQB: VLTLF)

Company Update: 14-Month De-Risking Sprint – From Lab to Commercial Scale in Record Time

Author: Joe Gantos, Senior Analyst

Date: October 27ᵗʰ, 2025

Recommendation: STRONG BUY

Target Price (12-18 mo): C$3.00 – C$5.00

Current Price: C$.48

Market Cap: ~C$84 million

Shares Outstanding: 172,933,853 (as of August 29, 2025)

Cash (Q3 2025): C$4.8 million

The Fastest Path to Lithium Extraction

Over the past 18 months, LibertyStream Infrastructure Partners (formerly Volt Lithium, rebranded on June 25, 2025) has executed one of the fastest de-risking and scaling cycles in modern lithium development history. What began as a lab-scale concept in early 2023 and pilot operations as far back as May 2023 has evolved into a fully operational, continuously running commercial DLE system capable of processing over 10,000 barrels per day (bpd) of Permian brine, a feat no other North American DLE company has achieved at this pace or cost efficiency.

With on-site refining-unit now in final commissioning for a 10 tonnes per annum (tpa) unit, with installation substantially complete and commissioning phase initiated as of October 23, 2025, on schedule for initial commercial production in Q4 2025, first bulk shipments of battery-grade lithium carbonate scheduled for Q4 2025, and strategic offtake discussions accelerating with U.S. industrials via bulk samples sourced from the Texas field site to prospective customers for qualification and long-term supply agreements, LibertyStream is not just a lithium junior, it is on the verge of becoming the largest lithium carbonate producer in the United States within 18–24 months.

This transformation leverages the company’s proprietary nanotechnology sorbent and modular design, allowing it to extract lithium from low-concentration Permian brine (25-55 mg/L) with recovery rates consistently hitting 98-99%, all while avoiding the billion-dollar infrastructure burdens plaguing competitors.

This note details the step-by-step operational progression over 18 months, unique infrastructure advantage in the Permian Basin, near-term revenue catalysts, and path to 95,000+ tonnes per year, a scale that would position LibertyStream among the top 5 lithium producers globally, all from brine that is currently being disposed of as waste in one of the world’s most prolific oil regions.

The October 23, 2025, corporate update (Link) reinforces this trajectory, highlighting refining installation completion, entry into commissioning, and a US$500,000 North Dakota grant with partner Wellspring Hydro to validate battery-grade production for in-state cell manufacturing.

Source: Corporate presentation

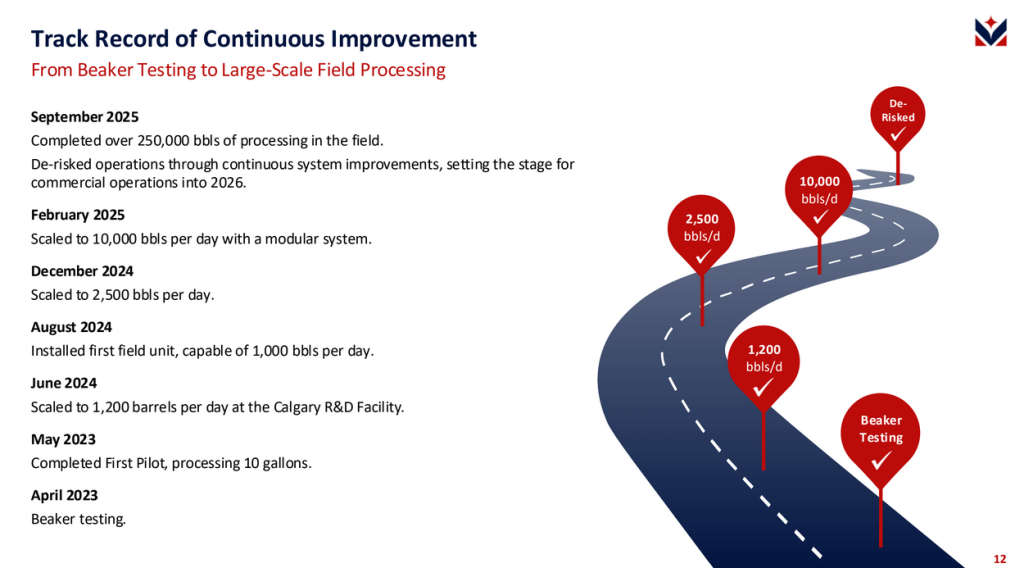

1. The 18-Month Journey: From Lab to 10,000 BPD Commercial Scale

LibertyStream’s rapid advancement began in March 2023 with the launch of a pilot program at its facility in Alberta, Canada, utilizing field brine sourced from its Rainbow Lake property. This initial phase successfully validated the company’s Direct Lithium Extraction (DLE) process using produced water from legacy oil wells. The pilot focused on demonstrating technical feasibility for low-grade brines, generating foundational data on sorbent performance and lithium chloride yield.

By late 2023, LibertyStream commissioned a demonstration plant in Calgary to evaluate its proprietary DLE technology under controlled conditions. Brine samples were sourced from oil and gas basins across North America, enabling rigorous testing of the core chemistry. The central question: Could LibertyStream’s nanotechnology-based sorbent reliably extract lithium from brines with concentrations as low as 30 parts per million, levels widely considered uneconomic? Laboratory results showed recovery rates exceeding 90%, marking a breakthrough. However, the critical challenge remained: scaling the process beyond laboratory conditions to validate performance in operational environments.

In mid-2024, LibertyStream achieved a major milestone with the commencement of field-scale lithium production. Operations began in September at its Texas facility with an initial throughput of 600 barrels per day (bpd). By December, the company had scaled its Generation 4 system to 2,500 bpd, supported by over 200 operational runs that refined process parameters and confirmed system reliability.

In early 2025, LibertyStream successfully scaled its operations with the deployment of its Generation 5 Field Unit, marking the transition to first-stage commercial production. The system demonstrated throughput exceeding 10,000 barrels per day (bpd), achieving a peak 24-hour continuous run of 11,573 bpd in February 2025. This milestone validated real-time brine processing from active oil wells via integrated salt water disposal (SWD) infrastructure, without requiring new permitting or facility construction.

The Generation 5 rollout introduced a fully automated, modular four-unit system capable of 24 hour extraction, stripping, and concentration. By August 2025, the system had processed over 250,000 barrels and completed more than 2,000 DLE cycles, establishing LibertyStream as the clear leader in operational scale. For comparison, Standard Lithium’s 2025 pilot processed just 2,300 barrels, underscoring LibertyStream’s execution advantage.

Operational challenges, such as flow rate optimization to prevent sorbent clogging and maintaining consistent stripping cycles, were resolved through direct field leadership. CEO Alex Wylie’s on-site presence, living in a trailer during commissioning, ensured rapid troubleshooting and system stabilization.

Key enablers of this success included:

- Proprietary media refinements enabling sub-hour cycle times

- Closed-loop automation for 24/7 processing

- Seamless SWD integration eliminating permitting delays and infrastructure bottlenecks

In parallel, LibertyStream conducted a June 2025 field trial in North Dakota’s Bakken region at Compass Energy’s Blue Marlin SWD facility. The trial achieved an average lithium recovery of ~96%, consistent with Permian Basin results and validating performance across basins that collectively represent over 60% of U.S. onshore oil production.

This 18-month progression, from lab validation in 2023 to full-scale field operations in 2025, has de-risked the entire value chain. LibertyStream now stands as the only DLE company with proven, at-scale lithium extraction from U.S. oilfield brines.

Recent additions, include the October 14th hire of Tim Frost (20-year Albemarle veteran with $800 million in annual sales oversight) and a US$500,000 North Dakota grant for battery-grade validation confirmed October 23, 2025, via the Renewable Energy Program with partner Wellspring Hydro for in-state battery cell manufacturing validation), further solidify the momentum toward revenue generation.

2. The Core Advantage: No Infrastructure, Infinite Brine

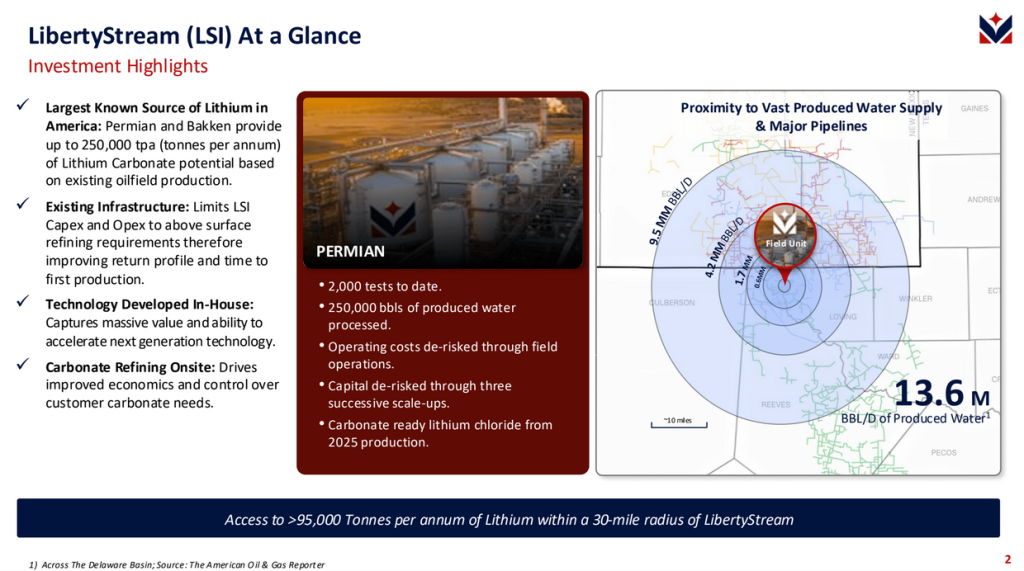

At the core of LibertyStream’s strategy is a symbiotic partnership with Permian Basin water midstream operators and major oil producers, including ExxonMobil, Chevron, and Devon Energy,who collectively generate over 20 million barrels per day (bpd) of produced water. This brine, a byproduct of oil extraction, contains an estimated 200,000 tonnes of lithium annually, representing the world’s largest untapped lithium brine resource.

For every barrel of oil produced, approximately three barrels of brine must be managed. This operational necessity has led to the development of a vast, decades-old network of pipelines and salt water disposal (SWD) facilities. LibertyStream’s model integrates seamlessly into this infrastructure: at an SWD site, the company diverts a brine stream for approximately one hour, extracts lithium using proprietary sorbent media, strips it into lithium chloride via hydrochloric acid, and returns the treated water for underground injection. Importantly, this process does not disrupt oil operations, if LibertyStream were not present, the brine would be disposed of regardless.

This approach eliminates the need for new wells, pipelines, or environmental permitting, components that typically account for up to 40% of operating costs in conventional DLE projects.

Transformational Economics and Infrastructure Synergies

- Capital Efficiency: Each 100,000 bpd modular unit requires just US$20 million in capex, translating to ~$20,800 per tonne of annual lithium production capacity, less than one-third the cost of peers such as Standard Lithium and Lithium Americas ($64,000–$72,000 per tonne).

- Water Crisis Synergies: Texas power plants and data centers consume over 900 million gallons daily, creating opportunities for desalination partnerships. Shared pretreatment steps, such as iron removal, yield $20–$25 per tonne in cost credits.

- Process Optimization: Q2 2025 upgrades in filtration and pre-treatment reduced impurities and reagent consumption, boosting overall system efficiency to 99%.

Localized Scale and Expansion Potential

Within a 30 to 40-mile radius of LibertyStream’s current operations, over 9.5 million bpd of brine is disposed daily, representing ~95,000 tonnes of lithium potential annually. This localized resource base is sufficient to supply major U.S. industries without expanding beyond the immediate region.

LibertyStream’s bolt-on deployment model, refined through more than 200 Generation 4 runs and 2,000 Generation 5 cycles by mid-2025, positions the company for rapid, low-friction expansion across the Permian and other U.S. oil basins.

Source: Corporate presentation

3. Scalability: From 1,000 to 95,000 Tonnes

LibertyStream’s modular architecture enables rapid, low-risk expansion across existing oilfield infrastructure. Beginning with its current 50,000 bpd SWD site, yielding approximately 500 tonnes of lithium annually, the company can triple output by adding capacity at a nearby 150,000 bpd facility, targeting 1,500 tonnes per year by H2 2026.

Expanding just 8 to10 miles unlock access to 1.7 million bpd of brine, translating to ~17,000 tonnes of annual lithium potential, surpassing many established producers. Within a 15-mile radius, LibertyStream can tap into the full 9 to10 million bpd disposal network, enabling up to 95,000 tonnes per year and positioning the company as the leading U.S. lithium producer.

Replicable Chemistry, Secure Supply, and Strategic Advantage

- Consistent Brine Chemistry: similar brine specifications across sites simplify replication and reduce engineering risk.

- Unmatched Supply Security: With 45 years of Permian drilling inventory, LibertyStream benefits from long-term feedstock certainty, supporting multi-year offtake agreements.

- Infrastructure-Driven Scalability: The model leverages existing disposal flows, avoiding the permitting, drilling, and construction costs typical of greenfield DLE projects.

Near-Term Execution and Strategic Expansion

- Gen5 Automation Upgrades: Scheduled from July to December 2025 to enhance throughput and reduce operating costs.

- Williston Basin Deployment: Q4 2025 site preparation underway in North Dakota, supported by a $500K grant, to replicate Permian success in the Bakken.

- Refining Unit Milestone: As highlighted in the October 23 update, the Refining Unit will play a central role in scaling domestic lithium production, with full-scale operations targeted for 2026.

LibertyStream’s bolt-on model, grounded in existing infrastructure and validated through thousands of DLE cycles, offers a clear path to national scale at a fraction of the cost and timeline of traditional lithium projects.

4. Refining: The Only U.S. DLE Refinery Outside China, Processing Oilfield Brines

LibertyStream’s lithium carbonate Refining Unit, acquired in July 2025 with a capacity of up to 10 tonnes per annum (tpa) for industrial and battery-grade applications, has reached a critical milestone in its installation at the Texas site. Site preparation began in early October, and the commissioning phase officially commenced on October 23, 2025 (as highlighted in the latest press-release). Initial hot tests and purity conversions, targeting up to 99.5% lithium carbonate, are scheduled to begin prior to full integration, keeping the project on track for Q4 2025 commercial refining.

CEO Alex Wylie affirmed the timeline, stating: “We remain on schedule to initiate commercial lithium carbonate production with the installation of our Refining Unit in Texas.”

The unit, now fully delivered and installed, is the only DLE-specific refinery outside China capable of processing oilfield brine. Full operational readiness is expected by October 31. The system will produce lithium carbonate at purities ranging from 98% to 99.5+%, customized to meet customer specifications without requiring EV-specific qualification. This flexibility enables rapid entry into underserved non-EV markets, which account for 40% of global demand and remain constrained by China’s dominance in refining (90% of global capacity).

Strategic Market Entry and Offtake Acceleration

- Target Markets: Initial focus includes industrial sectors such as glass, ceramics, medical-grade materials, and electrical components, where qualification timelines range from 3 to 9 months, compared to multi-year EV cycles.

- Bulk Sample Strategy: Commissioning samples of 0.5 to 1 tonne will be shipped to offtake partners, with full ramp-up expected in Q1 2026.

- Premium Pricing: Anticipated pricing ranges from US$15,000 to $20,000 per tonne, reflecting premiums over China’s ~$10,500 spot price (inclusive of tariffs, shipping, and scarcity).

- Feedstock Readiness: Stockpiled lithium chloride from Texas field operations is prepared for downstream conversion, directly supporting customer qualification and offtake commitments.

This acquisition and commissioning effort directly addresses downstream partner requirements for bulk field samples and positions LibertyStream to deliver high-purity lithium carbonate at commercial scale, further solidifying its leadership in domestic DLE innovation.

LibertyStream’s lithium refining unit, located adjacent to extraction facilities in the Permian Basin, West Texas. Source: Corporate press release

5. Offtake Pipeline: Industrial First, EV Later

LibertyStream’s offtake strategy emphasizes reliability, customization, and long-term alignment with industrial customers. Buyers with over 30 years of lithium carbonate experience are actively pursuing 10- to 25-year contracts, with site-specific tailoring to meet application-specific requirements, such as slight purity variations for ceramics versus glass manufacturing.

Pricing benefits from LibertyStream’s U.S.-based operations, with tariff-free, short-haul delivery from West Texas to Southern industrial hubs. This domestic footprint enables superior margins compared to export-dependent peers. While automotive OEMs are not yet engaged, this is a deliberate focus: industrial segments offer faster revenue cycles, simpler qualification pathways, and right-sized volumes for a scaling producer.

Near-Term Commercial Milestones

- Bulk Sample Distribution: Refined lithium carbonate samples from the Texas site will be provided to prospective customers in Q4 2025 and Q1 2026 to support grade validation and reliability testing for long-term agreements.

- Initial Offtake Agreements: LibertyStream aims to secure and announce its first commercial offtake contracts in early 2026, leveraging field-validated carbonate production.

- North Dakota Expansion: A $500,000 grant from the State of North Dakota (finalized October 27, 2025) supports site qualification, third-party testing, and sample creation for battery cell manufacturing in partnership with Wellspring Hydro, the University of North Dakota, and cathode manufacturers.

As CEO Alex Wylie stated: “We’re honored to receive continued support from the State of North Dakota, which enables us to expand our refining capabilities and advance in-state lithium carbonate production to support future battery cell manufacturing.”

This initiative lays the foundation for a vertically integrated lithium ecosystem in North Dakota, complementing LibertyStream’s industrial offtake strategy and positioning the company for future battery-grade market entry.

6. Valuation: Absurdly Undervalued

Despite a Q2 2025 net loss of $5.7M for the six months (driven by $907K R&D, partially offset by $1.05M grants) and low cash of $137K as of June 30, recent financing provides runway: A $3.53M promissory note (led by Pathfinder, with insider support) closed in Q2, 2025. Combined with US$700K ND grant (August 11) and the October 23 US$500K award, these funds are refined and scale-up through Q4. Working capital deficit of $1.1M reflects aggressive investment, but zero long-term debt and royalty income ($62K in H1) add stability.

In a base case, a 17,000-tonne-per-year ramp by late 2026 at $18,000 per tonne revenue and $14,000 margins generates ~$238 million in EBITDA. At an 8x EV/EBITDA multiple (conservative for growth peers), that’s a C$1.9 billion valuation, over 22x current levels.

A longer term and ultra-bull case at 42,000 tonnes pushes EBITDA to $588 million, implying C$5.88 billion at 10x to 68x upside. With a C$84 million cap today, LibertyStream trades at just 1x forward cash flow, ignoring its structural advantages.

7. Peer Comparison: David vs. Two Goliaths

LibertyStream’s lean model shines against competitors: Standard Lithium requires $1.4 billion for first production in 2029–2030, with undisclosed OpEx burdened by infrastructure. Lithium Americas faces $2.9 billion for a hard-rock start in 2028, without any field lithium processed yet. LibertyStream $20 million CapEx to initial output now, and 250,000+ barrels already under its belt, proving execution where others promise.

The Q2 filings highlight this lead: Gen5’s 11,573 bpd peak in February 2025 outpaces any peer’s field volumes by orders of magnitude. The October 23 update’s refining commissioning further widens the gap, with peers years from similar milestones.

8. Risks (Managed)

Price volatility (~$10,500/tonne spot) is buffered by U.S. premiums and contracts. Scaling risks are low given modular tech and proven volumes. Competition remains minimal, no peer ships samples yet, or has U.S. refining. Partner risks are mitigated by the Permian’s 45-year inventory. Financing needs (e.g., ongoing promissory notes) add dilution risk, but grants like the US7.5M North Dakota facility with US$4.2M remaining, provide non-dilutive support. Forward-looking risks include potential delays in Refining Unit commissioning or offtake qualification, as noted in the October 23 release.

9. Investment Thesis: The Fastest Path to U.S. Lithium Leadership

- Already producing, peers are still permitting.

- Refining live by Q4 2025, with commissioning underway as of October 23, early 2026 revenue inflection.

- 95,000 tpa potential, largest U.S. producer.

- Q2 momentum, including ND trial success and refining acquisition, accelerates this trajectory, bolstered by the October 23 update grant win and bulk sample rollout.

Price Target

Q4 2025 bulk samples, offtake announcements, and refining startup target C$0.80; H2 2026 1,000 tpa ramp to C$1.50; late 2026 to early 2027 scale-up to 7,000+ tpa exceeds C$3.00+ and potential scale-up to 17000 tpa H2-2027 would bring the target price to $5+.

STRONG BUY – Speculative investment

Initiate / Add on Weakness

High Conviction Core Holding

Disclosure: The author holds a long position in LIB.v in the Canadian markets and VLTLF in the U.S.

This is not investment advice. Conduct your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.