The First time I met Aptose Biosciences (APTO) was at the Bloom-Burton conference in Toronto back in May 2018 following the request of several Chimera Research Group (CRG) subscribers. They asked me to check out the company’s presentation and try to get more info about the status of the clinical hold and when we might expect it would be lifted. APTO stated they were working to finalize the APTO-253 clinical hold complete response to the FDA, which they hoped to file imminently and from the date of receipt by the FDA we would have 30 days to wait before receiving the Agency’s decision.

As a biotech trader, I began my own due diligence ahead of the presentation, the chart encouraged me to keep digging as I saw a long side-ways trading pattern with momentum starting to pick up. The price was trading between $3.14 to $3.35. I anticipated that the imminent release from clinical hold may lead to a typical run up in the price with a spike on the day that the hold indeed was lifted.

At the conference I listened to APTO’s presentation by Dr. William Rice, CEO, who left the audience with a strong impression of a sharp and straightforward CEO, moreover surrounded by an impressive management team and advisory board who were going after important indications with novel approaches.

During the presentation Dr. Rice explained that APTO-253 had been placed on clinical hold for solubility related CMC matters, and they were completing the plan to get the clinical hold lifted. APTO had optimized the drug formulation (3x the exposure of the prior formulation) and manufacturing which included stability, sterility, and simulated infusion studies, as well as animal bridging studies, in order to demonstrate the fitness of the drug product for clinical use. All that was left was to collect the final reports and submit the complete response to the FDA.

One month later in the updated June corporate presentation (Link) the company stated “Submitted Hold Response to the FDA” which gave the signal for the run up in the share price. We went full force, buying in the $3.25 area, taking profits the day the hold was lifted (Link) on June 29th to bank profits of 47% in just one month.

But as mentioned before, I continued my deep dive into APTO’s pipeline which has two very compelling assets at an early stage but with huge potential. The short-term decision was to take profits for a quick trade, but then wait for the normal technical correction, and let the share price form a strong base with a few weeks of consolidation, then start building back a long- term position to follow the two assets into the clinic and wait for the phase 1 results. I believe the opportunity is knocking again as the price dropped to the $2.01 support line along with the biotech sector sell off.

APTO Financials

The day the clinical hold was lifted, APTO’s share price spiked during the pre-market reaching the high of $5.49, but then began fading back as the profit taking started, to close at $4.50 per share. Despite the US$18.5 million in cash at the end of Q2, which provides the company with sufficient resources to fund research, development and operations into 2H 2019, the sell-off continued, forming a downtrend channel and reached a bottom at $2.60 on Aug 06th. Buyers stepped in at this point and began accumulating shares on the ASK side of the market. This was the first signal of a new side-ways trading pattern leading to a consolidation, which would form a strong base from which to prepare for the “reversal pattern” to start the new leg-up.

In the following weeks the rumor of a public offering start circulating in social media adding to pressure on the share price, notwithstanding that the company had US$18.5 million and had recent insider buying. In addition, Aspire Capital had committed to purchase up to $20 million of common shares at Aptose’s request from time to time until April 7, 2020. Moreover, an ATM agreement with Cantor Fitzgerald filed back in March 2018 was in place qualifying the aggregate offering of up to US$30 million. To date they have used only US$5.2 million.

So, the worries of a public offering and capital-raising were unfounded, as the cash on hand was more than sufficient for the next 12 months. I expect APTO to use the ATM or the Aspire agreement only after meaningful news at much higher prices, where they can raise the needed amount of cash by selling a smaller number of common shares and ease the dilutive effect on the current shareholder. This also ensures that they continue to keep the capital structure clean with only common shares outstanding (No warrants, preferred stock or debt).

Meanwhile digging even more into the APTO-253 and CG-806.

APTO-253 Phase 1b Stage First-in-Class Inhibitor of MYC Expression

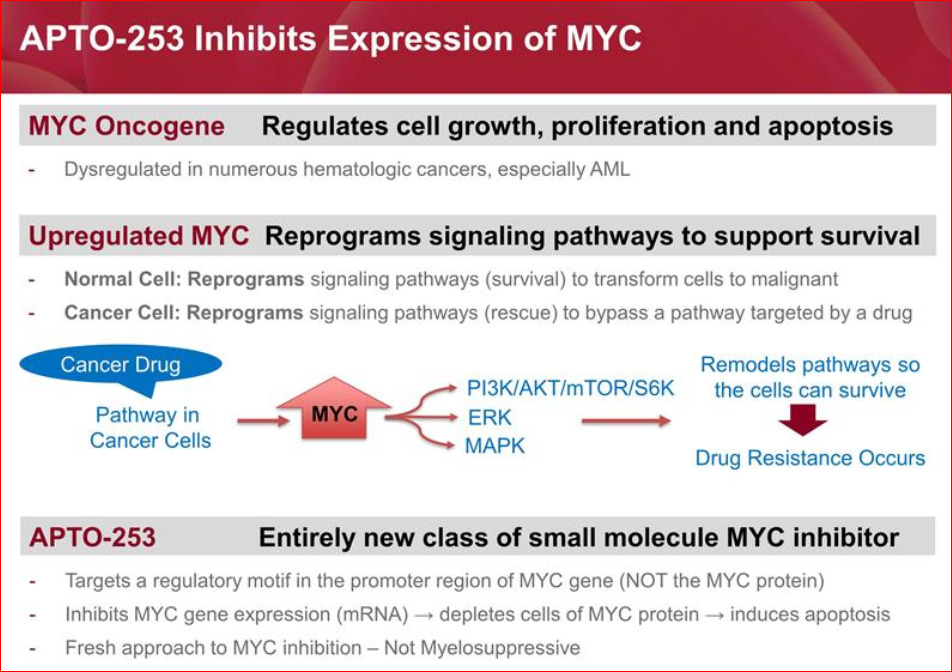

APTO-253 MYC Inhibitor is the only clinical stage agent directly targeting the MYC oncogene. The MYC gene is considered a proto-oncogene. In normal cells the MYC protein is essential to normal cellular functions and acts as a transcription factor to influence the expression of hundreds of other genes that regulate cell survival, growth, proliferation and death. However, the MYC gene can acquire a superenhancer that drives over-expression of the gene or it can undergo mutations that cause dysregulation of the MYC protein. In such cases, the MYC protein becomes an “oncoprotein” to support cell survival and inhibit cell death processes. This can lead to transformation of normal cells to malignant cells.

MYC has an additional role in malignant cells – drug resistance. When a cancer patient is treated with a drug that targets a particular pathway, the tumor cells may respond by overexpressing MYC. The MYC then acts on various signaling pathways to remodel those pathways so the cells can circumvent the pathway targeted by the drug and the cells can now survive in the presence of the drug. In effect, MYC allows the cancer cells to become resistant to particular cancer drugs.

Unfortunately, the MYC oncoprotein has no enzymatic activity or active site for a drug to target. This has led to MYC being regarded as undruggable. Also, inhibitors of BET (bromodomain or BRD) proteins have been targeted to inhibit expression of the MYC gene. If MYC has a superenhancer to drive excessive expression of the gene, then the superenhancer is heavily populated with the BRD proteins. A BRD inhibitor can then target the BRD protein and inhibit MYC expression. Unfortunately, BRD proteins reside on all active genes, and the BRD inhibitors are consequently quite toxic.

APTO-253 targets the G-quadruplex (G4) DNA motif in the promoter of the MYC gene, thereby stabilizing the G4 motif and inhibiting expression of the MYC gene. APTO-253 therefore targets the MYC gene promoter to block production of MYC protein but does not directly target the MYC protein or the BRD protein. Consequently, APTO-253 represents a new class of MYC inhibitors.

APTO-253 is currently at Phase 1b stage for the treatment of acute myeloid leukemia (AML) and high-risk myelodysplastic syndrome (MDS). Since being released from clinical hold APTO has updated the IRB’s about the modified formulation and changed the patient consent forms. APTO has already received IRB approval at several sites and started screening patients, 15 sites are expected to participate in the 20-patients dose-escalation study. Only one AML patient is required at the low / first dose and one patient at the second dose. As these initial doses are expected to be sub-therapeutic, management is being very careful and selective with the patients they put on the study. AML is a tough disease and patients are extraordinarily sick, so APTO has had to turn away number of patients during the screening process as their condition / performance status was too poor (most of the AML patients at this stage are in life threatening condition) and they need to be able to complete the full 28 days cycle. So, APTO is being prudent in their selection of patients at the two lowest dose levels in an effort to avoid delays and to expeditiously reach dose levels that are considered to deliver therapeutic exposures that can potentially demonstrate benefit to the AML patients.

Management is carefully evaluating patient selection for inclusion in the first two dose levels to ensure only candidates with favorable condition/performance scores and capable of completing the 28-day cycle are considered. Although this may add time to recruitment, it may save time in the long run. This minimizes the risk of an SAE or death and should avoid having to recruit 6 patients (vs. 2) in the first two dose levels. Depending on how quickly they can recruit the first two patients, APTO believes that by the 3rd dose level they should be close to the therapeutic threshold. This is a good example of an experienced management team making astute decisions in order to minimize risk

CG-806 Oral Pan-FLT3 / Pan-BTK Inhibitor

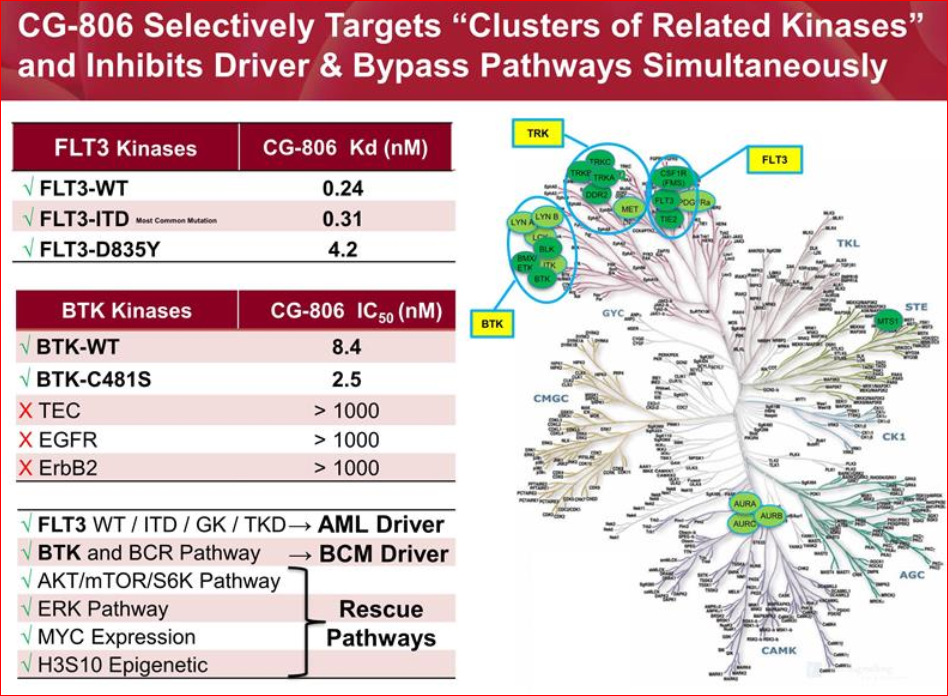

APTO had been looking to expand their pipeline with an additional pre-clinical drug candidate and had set specific criteria for their search. After numerous meetings they found a small company in South Korea called “CrystalGenomics” that had created a molecule designed to inhibit Bruton’s Tyrosine Kinase (BTK). Upon further investigation they recognized it to be a potentially highly potent inhibitor of the wild type BTK as well as the C481S mutant forms of BTK. In addition, they found it to inhibit the FLT3 receptor tyrosine kinase. This was a huge surprise as no other drug had ever been shown to inhibit BTK and FLT3. After having 3rd parties replicate the results in the US, APTO took the risk and in-licensed the molecule despite the fact that it was early in the development and there wasn’t a synthetic process to manufacture the molecule. Subsequent pre-clinical studies found that CG-806 not only inhibited all forms of BTK and FLT3, but also inhibited a couple of other key pathways that are critical to the survival of cancer cells that originate in the bone marrow and blood cells. FLT3 drives AML but other pathways are also involved, and CG-806 inhibits these other pathways. The same is true for B-cell malignancies in which inhibiting BTK is not enough, you have to hit BTK and the other pathways that allow for drug resistance. In Aptose’s pre-clinical work with CG-806 it was able to demonstrate its ability to do so.

APTO plans to perform parallel development in AML patients (known as an acute disease) and in patients with B-cell malignancies (B-cell patients are more chronic form), like chronic lymphocytic leukemia (CLL) and non-Hodgkin’s lymphomas, in which BTK plays a critical role in pathogenesis. Importantly, CG-806 may be beneficial to patients with B-cell malignancies whose cancer is resistant or refractory to earlier generation BTK inhibitors.

Upon IND approval APTO will begin a Phase 1 dose escalation study in B-cell cancer patients while simultaneously initiating a healthy volunteer dose escalation study in advance of treating AML patients. The healthy volunteer arm was at the suggestion of the FDA, as this approach could lead more quickly to establishing a therapeutic dose and was predicated on the very clean tox profile CG-806 has exhibited to date. This also mitigates the ethical issue of concern to the FDA, the dosing of acutely sick patients with sub-therapeutic doses of experimental drugs. However, before starting the healthy volunteer study APTO must perform several additional studies which include a genotoxicity study, single dose CNS (Central Nervous System) safety analysis, as well as respiratory and cardiac safety studies in animals, which will add a few additional weeks to complete and could push the IND submission into early Q1 2019 as explained by Dr. Rice at Leerink fireside chat (Link).

If final toxicology data confirm the safety of CG-806 the company plans to start with a SAD (Single Ascending Dose) study in which a healthy volunteer receives a single dose followed by PK follow up for one week, which should lead to 2nd volunteer for a higher dose and from there continue to dose escalate weekly for 3-5 dose levels. This potentially should lead to an optimal dose for therapeutic exposure from which to proceed into the sick AML patient population. This may save time to clinical POC (proof of concept) and de-risks the drug.

Technical Analysis:

The deep correction in the biotech sector where the IBB and XBI have corrected over 20% in the past 2 months, has added pressure to APTO’s share price, leading the price down to test the strong weekly support line at $2.01. From this level it started forming a bullish divergence in the MACD indicator. A closer look at the indicator shows that despite the negative trend in the past two months, the MACD is showing a “Positive Divergence”. Positive Divergence is a condition when the price has a lower low, but the indicator measuring the same price does not, instead it has a higher low, this usually implies that the selling pressure is weakening.

APTO could be a great pick at any point between $2 to $2.40 ahead of the year-end catalysts,with favorable risk/rewards especially if we consider using a tight stop-loss to reduce risk, just a few points below October 09th lower point around $1.81. With the recovery in the biotech sector combined with APTO’s positive news ahead of the year end, this should start a new leg-up. With a bounce off the $2.01 support line, the next target would be to break through the $2.51 resistance, which would likely be followed by a move through the 50-Day moving average around $2.55. While breaking out the downtrend channel’s upper line (light brown lines on the chart) will most likely push the price to the next target, the 200-Day moving average around $3.1 which is achievable on any positive news such as APTO-253 first patient being dosed, which could happen any day.

Disclosure: The author is long APTO.