Perimeter Medical Imaging AI (PINK.v) is a Toronto-based company with U.S. headquarters in Dallas, Texas developing advanced imaging tools that allow surgeons, radiologists, and pathologists to visualize microscopic tissue structures during cancer excision surgery.

Perimeter has an innovative FDA 510(k) approved medical device, soon to launch commercially, that is ready to disrupt breast cancer surgery practice, along with a vision to optimize the imaging of the future with Artificial Intelligence (AI). Perimeter’s device, OTIS, incorporates optical coherence tomography imaging with a proprietary tissue immobilization system and user training algorithm built from an in-house tissue sample atlas. This system is now ready to launch commercially in the US in early 2021 following transactions that have capitalized the company for a sales push. Combining this platform with a machine learning-driven AI system it is developing, Perimeter intends to establish a next-generation technology compatible with the same OTIS platform to drive further widespread adoption of the device within a few years of launching OTIS commercially. Perimeter’s cancer tissue imaging innovation is coupled to an outstanding management team and has attracted renowned experts to the clinical and scientific advisory board, a crucial element for any medical device company’s success.

To understand this investment opportunity and the OTIS platform, we first need to examine the indication – breast cancer – where it will be implemented first and the unmet medical need therein: Breast Conservation Surgery (BCS)

BREAST CONSERVATION SURGERY

The Problem: Re-excision

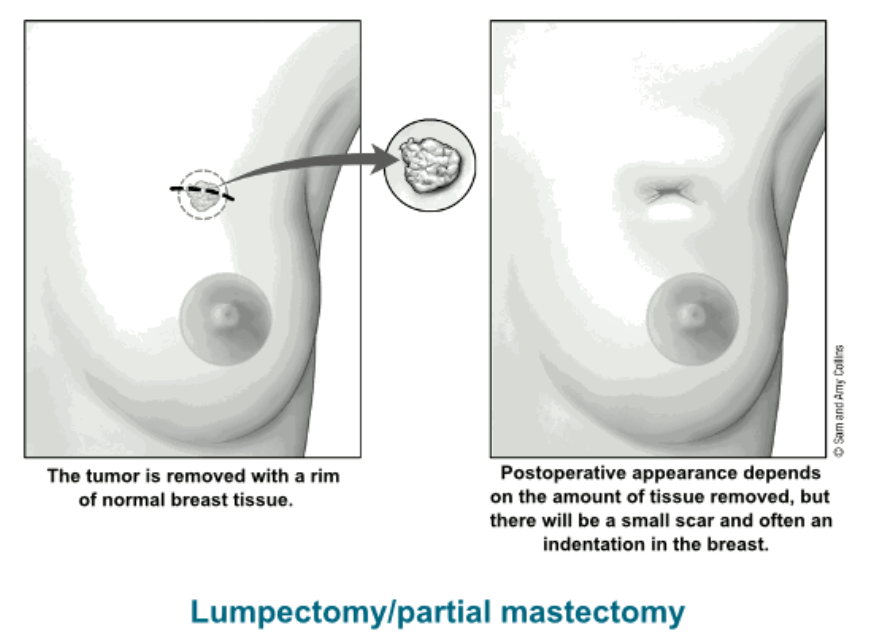

Breast conservation surgery (BCS), also referred to as lumpectomy, consists of the surgical excision of cancerous tissue from the breast. This would typically be followed up by standard of care radiation or chemo treatment as indicated. An estimated 200,000 women receive BCS each year in the US and Canada. This procedure is in contrast to a mastectomy whereby the entirety of the breast is removed. BCS presents a compromise option for women to retain some natural breast tissue while removing only the cancerous tissue and a small amount of surrounding tissue margin. However, a major factor in the potential for recurrence and a poor prognosis following this procedure is the presence of “positive margin.” Positive margin refers to the presence of cancer cells at the very edge of the resected tissue. If retained in the tissue, these cells can produce an aggressive recurrence. In contrast to bulk tumor, these cells are microscopic and more challenging to assess and distinguish from normal tissue. Because of the absolute necessity of surgically removing all cancerous cells from the breast cancer patient, a re-excision is performed when positive margin is detected on the resected tissue. The re-excision is a second surgery to remove additional tissue until the margin is negative and the patient will be left with no remaining cancerous tissue.

Tissue histology is the current standard for examination of the margin following BCS, and its turnaround time is several days to a week. The re-excision is therefore typically a second, separate operation, and fully billed, like the original surgery. This puts the patient through multiple surgeries with added risk of complications and infections, increased out of pocket expenses, an added psychological and emotional stress that their tumor may be exceedingly difficult to remove, prolonged recovery from surgery, and a delay to the start of follow-up radiation. Other existing imaging technologies such as X-Ray and ultrasound lack the accuracy to substitute as a reliable intra-operative technique to eliminate the need for re-excisions.

It is estimated that re-excision rates are around 25% of all BCS. This can reach as high as 40% at some sites within the community hospital setting, where surgeons are performing fewer breast cancer surgeries each year and lack the skills of surgeons from large medical institution performing 100 or more lumpectomies per year. This is a significant cost burden on the healthcare system and particularly burdensome to patients. The elimination of re-excision altogether or the reduction in re-excision rates to as low as 5% would revolutionize BCS and drive a competition for patients among hospitals who would need to have this technology to compete. Given the cost of each surgery at around $16,000 this would also provide value to the healthcare system in reduced costs and risk of complications.

Source: American Cancer Society, 2019. link

Source: American Cancer Society, 2019. link

The Solution: OTIS

OTIS provides an intraoperative solution to margin assessment within the operating room, giving surgeons the ability to act on “positive margin” and remove additional tissue while the initial surgery is still ongoing, thus eliminating the need for a re-excision surgery weeks later. OTIS uses widefield optical coherence tomography (OCT) to provide multidimensional tissue structure imaging up to 2mm below the surface at 6.5-15 micron level resolution. This technology uses near infrared light and the principle of light scattering to distinguish cancer cells by virtue of their highly scattering nucleus-to-cytoplasm density compared to adipose cells. This imaging provides 100x more resolution than MRI and 10x greater resolution than ultrasound. This results in the high sensitivity and specificity needed for an intraoperative margin assessment tool that ultrasound cannot offer.

In a study published in 2019 testing this system at Mount Sinai Hospital in New York City, 178 out of 185 tissue samples evaluated by OTIS were concordant with the histology readings. One of the key aspects of OTIS 2.0 is non-destructive real-time imaging providing full preservation of the tissue for later histology follow-up. This is achieved in part by the OTIS proprietary tissue immobilization system, which is a single-use consumable essential for imaging in each procedure.

Source: Perimeter Medical Imaging AI

Source: Perimeter Medical Imaging AI

Perimeter received 510(k) clearance from FDA to market OTIS 2.0 in the US in 2019. Thanks to recent capital raises, the company is well-financed to commercialize OTIS beginning in 2021. Perimeter intend to hire 8-10 sales reps with a strategy focused initially on a group of 500 potential early adopters in the large academic hospital setting, targeting those already experienced with other types of image reading who would be more easily trained on the OTIS module. Re-excision surgeries cost an estimated $16,000 and with rates assumed at 25%, the average BCS has $4,000 in additional costs due to re-excision. By cutting re-excision rates at least in half with OTIS 2.0, the device can produce savings north of $2,000 on each BCS. With these kinds of numbers, a clinic performing BCS 100 times per year would make back their capital investment on the instrument ($150k) within the first year. Longer-term, the commercial rollout would expand to the community setting, where re-excision rates can be as high as 40%, but the number of yearly surgeries is lower. Ultimately, the vision for expanding the adopter base even further will depend on the next generation of OTIS technology incorporating AI with ImgAssist.

The Future: OTIS 2.0 platform with ImgAssist AI

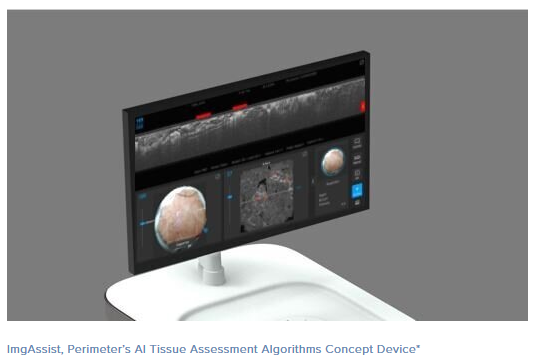

Concurrent with the commercial rollout of OTIS 2.0, Perimeter is developing an AI component, “ImgAssist,” to automatically detect images of interest within the OTIS OCT scans and point the surgeon’s attention to margin hotspots in need of review. To fund this research, Perimeter received a US $7.4 million grant from CPRIT, Cancer Prevention and Research Institute of Texas. This next-generation add-on is intended to “democratize” OTIS, driving a more universal adoption, and expanding its reach further into the community hospital setting and among surgeons less experienced with image analysis. ImgAssist could drive down re-excision rates with OTIS even further while making it easier for surgeons to use via automation.

Source: Perimeter Medical Imaging AI

Source: Perimeter Medical Imaging AI

Machine learning and AI in medicine is often touted as a way to revolutionize care, but in many cases the hype exceeds its current capabilities. Ultimately, AI’s utility is limited by the quality (and quantity) of its data inputs. But the one area where AI is truly ready for prime-time and has already proven its worth in medicine is with imaging. Thus ImgAssist is a real-world application of AI with strong probability of success unlike other pie-in-the-sky visions for AI. This is why the potential of ImgAssist is so exciting and why Dr. Ted James, Chief of Breast Surgical Oncology at Beth Israel Deaconess Medical Center of Harvard Medical School, and member of Perimeter’s Clinical Advisory Board believes it will be “The Holy Grail of BCS” intraoperative imaging. Given that Perimeter was the only recipient of a grant from CPRIT out of 30 applicants, CPRIT’s belief in the potential of ImgAssist is evident. Perimeter already has a proprietary library of over 1.4 million breast cancer images serving as a high quality data input to train their AI algorithm, and the OTIS platform providing OCT image outputs for AI reading is already established and well-suited for this purpose.

As an example of how imaging AI is already changing medical practice, “EyeArt” was recently FDA approved (August 2020) as a tool to automatically diagnose more-than-mild diabetic retinopathy and vision-threatening diabetic retinopathy from eye images taken from diabetes patients. This incredible tool shows the power of AI in imaging, and perhaps more importantly it demonstrates that the regulatory path is cleared should Perimeter’s ImgAssist demonstrate its worth in clinical trials. This story will play out over 2021 and 2022, as some data on this innovation will be shared in early January 2021, followed by the initiation of a randomized controlled trial early next year. The early data could be eye-opening and could generate excitement in the field as well as for the stock price.

The investment opportunity: Potential Multi-bagger

Given all the above, Perimeter presents an attractive investment opportunity. At a current market cap of ~$80 million, make it a good candidate for our favorite investment type of “Under-the-Radar” stock with multi-bagger potential. In terms of Perimeter’s revenue opportunity, capital revenue from OTIS installation is $150k and each installed device will produce consumables revenue of $750 per procedure from tissue immobilization along with 10% ASP reimbursement. Assuming 3 surgeries per unit per week, this would translate to a $56m yearly recurring revenue opportunity in the US alone if they can achieve 500 installed devices among their target early adopter population, which would reflect only about 20% penetration of the US market.

The development of ImgAssist AI could drive market share much higher, but even at $50m in revenue and a very conservative projection, this stock has 10-bagger potential. If we get a little more aspirational and look at Faxitron as a proxy, the numbers become staggering.

Faxitron is a med-tech company that developed an X-Ray imaging device used to assist a surgeon in confirming the removal of surgical guidewire from the breast during the cancer surgery. Faxitron successfully installed 7,000 of their X-Ray devices (also $150k) into hospitals performing breast cancer surgeries in Western world markets. If we assume 2 surgeries per unit per week for 50 weeks per year, the analogous Perimeter medical revenue opportunity would be $500m/year with 7,000 installations. At its current levels, this obviously makes the stock a screaming buy.

Considering there are 140,000 lumpectomies in the US each year, at $16,000 per surgery the 25% re-excision rate costs the healthcare system $560 million. Decreasing this rate presents a compelling value proposition to payors increasingly focused on value-based provision of care in addition to all the benefits to patients and surgeons looking to optimize their procedures. In the long-term future, if Perimeter can establish OTIS and/or OTIS with ImgAssist in the breast cancer marketplace, there is a further $3.7 billion addressable market for cancer imaging applications in indications outside of breast cancer. This of course means that the success of OTIS in BCS will not only drive Perimeter stock higher but also establish the company and its technology platform as an attractive takeover target.

The Cash position and financial hurdle:

In July 2020 Perimeter went public through a private placement offering and reverse takeover of New World Resource Corp, Perimeter raised $9.4 million with potential future proceeds of $13.5 million from the exercise of associated warrants. The pricing of outstanding warrants are $2.0 (50% of them) and a range from $1.20 to $1.92, which are all in the money and therefore a realistic source of additional capital for the company going forward. This along with the non-dilutive $7.4m grant from CPRIT supports the company’s cash burn out to 3 years, so the financing hurdle is out of the way, leaving execution as the primary task.

Perimeter is listed on the Toronto Stock Exchange under the ticker symbol PINK.V, and on the OTC market under NWFFF, which is the legacy listing of New World Resource. Management has confirmed they are working on a direct US listing on the OTCQX which should be complete within a few weeks and will lead to a new ticker symbol on the US OTC market.

Enabling the commercial launch: Experienced, world-class management team

Given that commercial success of OTIS will be the largest driver of an investment in Perimeter stock, our confidence in its ability to sell the device is key. Perimeter has a seasoned management team with extensive experience in developing and marketing medical and imaging devices. The team is led by Mr. Jeremy Sobotta as CEO with a diverse background in the medical devices industry supporting many different geographies and go-to-market models. Sobotta was involved in the deployment of over $4 billion in capital in acquisitions over his career. His prior roles included Head of Finance for the Stryker business unit responsible for surgical equipment and women’s health.

We are particularly confident in recently hired Chief Commercial Officer Steve Sapot who previously led the capital sales team at Faxitron, which successfully installed 7000 X-ray based medical imaging boxes in breast cancer surgery hospitals in western markets. Mr. Sapot is someone who knows how to engage with the targeted marketplace and already demonstrated tremendous success in doing so, in addition to his other prior experience leading sales at reputable med-tech companies, ConMed Electrosurgery and Barrx Medical. We are confident that surgeons and hospitals will understand the clear benefits of OTIS through strong communication of an effective sales organization at Perimeter led by Sapot.

Upcoming catalysts to potentially drive stock price higher:

- The company currently has 2 manuscripts in peer review providing further scientific evidence for OTIS utility in BCS, and these are expected to publish in Q4. This will help drive adoption when the commercial launch is initiated next year as the scientific evidence for OTIS 2.0 mounts, clarifying its capabilities to surgeons.

- Commercial rollout of OTIS 2.0 initiating early 2021, fully launching in April to coincide with American Society of Breast Surgeons annual meeting, where Perimeter will generate surgeon awareness and further publicize OTIS capabilities.

- The ImgAssist AI project is currently being refined, and early data on this technology will be presented in January. This early data could generate excitement for physicians which perfectly segues into the launch of a randomized controlled trial in Q1. If the early data are impressive, enrollment of the trial could progress quickly. It would also boost the stock as impressive data would point to the commercial future of OTIS with widespread adoption. The readout of the randomized trial, if successful, would provide another boost to the stock, but more will be known about the potential timing of a readout after the trial begins next year.

Summary:

Perimeter will launch its FDA-approved OTIS platform, a point-of-care imaging system that provides clinicians with real-time, ultra-high-resolution, sub-surface image of an excised tissue specimen’s margin at 2mm depth. The ability to visualize microscopic tissue structures during breast conservation surgery in addition to standard of care tissue assessment enables rapid decision-making during the procedure, can decrease the rate of re-excision surgeries by rendering them unnecessary, and has the potential to result in better long-term outcomes for patients and lower costs to the healthcare system. The company is well-financed to support commercial efforts and is led by a world-class leadership team. Concurrent with the commercial launch, Perimeter is developing the AI tool ImgAssist to further drive adoption in the future with improved technology and ease of use. Data readouts from OTIS and from ImgAssist over the next 3-6 months will provide catalysts that should generate further interest in the company and the stock. Perimeter stock (PINK.V on Toronto stock exchange, or NWFFF on OTC market) is under the radar and undervalued at $80 million market cap, providing a ground floor investment opportunity for a device that can revolutionize breast conservation surgery.

In our view, and based on the potential of OTIS successful launch starting by early 2021, targeting 30% of the total addressable US market, our base price target is C$7.00, and post launching the artificial intelligence (AI) plug-in for OTIS, ImgAssist AI our high sky price target is C$14.00.

Technical Analysis:

Perimeter is trading on the Canadian stock market under the symbol PINK.v while the US listing on the OTC is still using the legacy ticker of NWFFF that reflects the price in Canada. This will be replaced with another ticker the day Perimeter completes its OTCQX listing.

As you can see from the chart, PINK.v started trading on 07/06/2020 and moved fast from the C$1.50 area to reach the high of C$2.49. Then a technical correction followed this quick move higher, which can be the result of some quick profit taking by traders, while investors are in this name for the long run.

Despite the downtrend line and the price printing lower highs, the stochastics started printing higher highs, hinting of accumulation. This suggests the long-term investors are buying any rapid drops, as can be seen more clearly with the price action on 10/08/2020 where the price dipped and quickly recovered forming a “Bullish Hammer Candlestick” with the low of C$1.60 that can be used as a stop-loss point for any new buyers. Similar price action repeated on 10/28 on extremely large volume, with price dipping to C$1.70 and recovering fast to close at $1.90, which could mean the demand is larger than the ask, and large investors are stepping in to add more to their position.

The next important point will be the breakout of the upper downtrend line around C$2.30, followed by printing a New 52-Week high over C$2.49

Disclosure: Author is LONG PINK.v