Cardiol Therapeutics (NASDAQ: CRDL) (TSX: CRDL) is a Canadian company developing pharmaceutically manufactured prescription strength cannabidiol products (CardiolRx™ and CRD-38) as small molecule therapies for heart diseases, including pericarditis, acute myocarditis, and heart failure. CardiolRx™, its proprietary oral formulation, is currently in multiple Phase 2 clinical trials, one of which is set to read out in Q2. The results of the MAvERIC Phase 2 study in recurrent pericarditis (RP) will be an important milestone and catalyst for the company and its stock price. This study is positioned to provide the first clinical proof of concept for the symptomatic benefit of CardiolRx™ in patients with RP. If these data are positive, we expect CardiolRx™ will have an accelerated regulatory path forward to a Phase 3 trial and FDA approval on a very rapid timeline based on historical regulatory precedent. Given the commercial potential of CardiolRx™, successful proof of concept with the Phase 2 data would trigger a significant revaluation of the stock price. We will explain below why our level of interest in this trial readout is high, how it will derisk CardiolRx™’s path to a significant revenue opportunity in recurrent pericarditis, and why Cardiol is a compelling investment right now.

PERICARDITIS

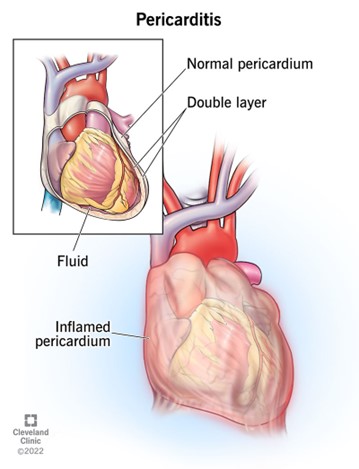

Pericarditis is a heart disorder consisting of inflammation of the pericardium, the membrane sac that surrounds the heart and protects it from damage during contraction. The pericardium’s normal role is to hold the heart in place, protect it from infection, and avoid friction with surrounding tissue. Pericarditis is usually triggered by a viral infection but can also be caused by bacterial infections, cancer, kidney failure, medications, or a heart attack.

Acute pericarditis lasts about 4-6 weeks before resolving, but often patients can experience a second episode. If another episode occurs following a period of 4-6 weeks without symptoms, this is considered recurrent pericarditis. The symptoms of pericarditis (and recurrent pericarditis) include sharp severe chest pain, shortness of breath, and fatigue.1 Although the most common complication of pericarditis is a recurrence, occurring in 15-30% of first-time pericarditis cases, some complications can be deadly, and an estimated 5% of all hospitalizations for chest pain in the US and Europe are due to pericarditis.2

Source: Cleveland Clinic

The medical field has been increasingly recognizing in recent years that pericarditis and its symptoms are driven by a complex immune-inflammatory system activation and that shutting off these processes can improve the symptoms and prevent recurrences. The anti-inflammatory, immune modulating, and anti-fibrotic properties of cannabidiol have also been elucidated in the past several years, pointing to a strong rationale and likely role for this small molecule in treating pericarditis. NLRP3 inflammasome activation in particular has been implicated as a driver of pericarditis pathology,3,4 while many studies have demonstrated cannabidiol as an inhibitor of this activation.5-8

CURRENT TREATMENTS AND UNMET NEED

Current treatment options are mostly off-label, consisting of NSAIDs for pain relief, colchicine (an ancient anti-inflammatory drug), steroids to suppress the immune system,9 and lastly, Kiniksa Pharmaceuticals’ drug Arcalyst (rilonacept), the first FDA-approved drug with a labeled indication specifically for recurrent pericarditis.10,11 We note that colchicine has been shown effective for recurrent pericarditis,12,13 and like cannabidiol, it also inhibits the NLRP3 inflammasome.14

Some patients cannot tolerate colchicine or corticosteroids, some do not benefit from them, and some patients become steroid-dependent, leaving plenty of unmet need. Arcalyst is an interleukin-1 (IL-1) trap molecule which clears circulating IL-1 from the system. Although it has multiple roles and potential activators, IL-1 is a downstream cytokine whose production is increased after the NLRP3 inflammasome is activated, triggering further inflammation and unwanted immune cell activation.15

Arcalyst is a repurposed drug, originally FDA-approved to treat CAPS, Cryopyrin-Associated Periodic Syndromes, which is a rare genetic disease caused by gain of function mutations in the NLRP3 gene.16-18 This is among many reasons why the success of Arcalyst in RP is bullish for CardiolRx™’s prospects in the same disease and why we are so optimistic about it. With the increasing knowledge of NLRP3 inflammasome’s role in pericarditis, Kiniksa licensed the rights (from Regeneron) to repurpose Arcalyst as a treatment for RP. Arcalyst previously demonstrated powerful efficacy in CAPS19 by blocking IL-1, which is downstream of the NLRP3 inflammasome pathway that is over-stimulated by CAPS gene mutations. Kiniksa ran an open label pilot study of 25 patients (identical design to Cardiol’s MAvERIC-Pilot study) followed by an 86-patient placebo-controlled Phase 3 trial to test the IL-blocking hypothesis in RP, and these trials showed an improvement in symptoms and a significant reduction in pericarditis recurrence by Arcalyst.20,21 These study outcomes confirmed the role of NLRP3 as a disease driver in patients with RP. Importantly, the clinical development of Arcalyst in RP was completed on an accelerated timeline of only 3 years.

THE POTENTIAL THERAPEUTIC ROLE OF CARDIOLRX™

A great deal of emerging research has shown cannabidiol, the active pharmaceutical ingredient (API) in CardiolRx™, acts on multiple inflammatory signaling pathways, including inhibiting NLRP3 inflammasome activation, and in doing so upstream of the activity of IL-1 inhibitors, is able to suppress not only IL-1 production but also the production of other cytokines and inflammatory signals that are likely playing a role in the RP pathology (IL-6 and caspase-1 among others).22 CardiolRx™ represents a way to target the NLRP3 inflammasome5-8 more directly at the source, which has great potential for treating pericarditis.23 . By inhibiting activation of inflammatory signaling pathways including the NLRP3 inflammasome pathway, CardiolRx™ will be hitting the cellular kill-switch responsible for RP disease pathology. The fact that this molecular pathway has already been validated as a successful way to tackle the RP problem with multiple proven drugs provide a major derisking of the CardiolRx™ clinical program.

Why an alternative to Arcalyst is needed and how CardiolRx™ can fill that void.

Arcalyst had impressive results in RP and strong market uptake since its launch in 2021, and this is bullish for CardiolRx™ since it reflects a market in need of innovation and ready to embrace it (we will elaborate further on the market opportunity below). However, there are some drawbacks to the use of Arcalyst that create a need for an alternative option. Arcalyst carries an extraordinary list price of $270,000 per patient per year, which is a major drawback and limits its use and accessibility. Furthermore, the drug is only available in the US and is immunosuppressive, which leads to increased risk for infection in patients. The high price stems from its original application in the ultra-rare CAPS indication (combined with its complex recombinant protein manufacturing needs and subcutaneous formulation). Kiniksa took a gamble that they could win over some RP market share with a powerful drug without lowering the CAPS-determined price. But because of the high costs, doctors will typically use it as a third or fourth-line therapy after NSAIDs, colchicine, and steroids, and they will also reserve it for patients with multiple recurrences (usually three or four).

The pool of available patients shrinks as the number of prior recurrences increases. For example, in its corporate earnings presentation, Kiniksa highlights a RP market of 40,000 patients, which shrinks to 7,000 with three or four prior recurrences and 14,000 in total with at least two recurrences. Cardiol is expected to provide a more reasonably priced option for CardiolRx™ (we project it to be in the $40,000-50,000 per year range) that should expand access and enable cardiologists to use it more broadly in recurrent pericarditis patients (~40,000 inclusive) and certainly more often in patients with two recurrences versus three or four.

Arcalyst is also a weekly subcutaneous injection, while CardiolRx™ is an oral drug taken twice daily. The idea of injections for life is not very appealing to patients especially in the context of a preventative; especially when the drug increases risk for infection. We expect RP patients, who are typically in their prime of life (usually in their 30s and 40s) will prefer oral therapy options before resorting to Arcalyst, and CardiolRx™ therefore would be used first. In addition to the cost savings for patients and the healthcare system, the previously mentioned increased infection risk associated with a powerful drug like Arcalyst that suppresses the immune system represents a major consideration for patients. Chronic dosing with Arcalyst is especially problematic for RP patients in light of information emerging from cardiologists that when patients try to wean off or discontinue the medication, they experience flares and therefore lack the ability to stop taking the drug over the long run. CardiolRx™ therefore could have an additional role for patients already on Arcalyst, as a way to prevent flares when attempting to wean off of a long-term use of Arcalyst. It remains to be determined if whether inhibiting the NLRP3 inflammasome upstream with CardiolRx™ will lead to a reduction in flares after discontinuing long-term use of Arcalyst.

WHY ARCALYST’S SUCCESS IS BULLISH FOR CardiolRx™

Regulatory Trailblazing

The success of Arcalyst both from a regulatory perspective and a commercial perspective is highly encouraging for a follower in this space like CardiolRx™. Cardiol is modeling the clinical development of CardiolRx™ in RP after the precedent set by Arcalyst, which had a rapid regulatory path to FDA approval (as noted above, a 3-year path to regulatory approval, is remarkably fast and indeed precedent setting in the world of cardiovascular drug development). With the regulatory pathway having been established as acceptable to the FDA, the path that Kiniksa blazed can now be followed by Cardiol without the regulatory risk and uncertainty that typically accompanies the clinical and commercial development of a new drug. There were three basic elements to the Arcalyst path to FDA approval in RP. It started with an open-label pilot study in 25 patients, then a placebo-controlled Phase 3 trial (in 86 patients), and finally Orphan Drug Designation.

Cardiol is following this identical blueprint but has in fact already achieved the last of the three pillars of this strategy, having just been granted Orphan Drug Designation (ODD) for CardiolRx™ in pericarditis by the FDA, a major achievement. This leaves the two clinical development steps remaining, with the upcoming readout from the fully enrolled phase 2 MAvERIC-Pilot study in 25 patients being the first. We will explain below why we are very bullish on this Phase 2 readout and why Cardiol’s recently received ODD represents a major milestone that carries extra significance concerning the likelihood of MAvERIC-Pilot’s success.

Strong Market Uptake

In only its first full year of sales in RP, Arcalyst was strong out of the gates as Kiniksa reported $122.5m in revenues. The growth of the product has continued apace since then, with $233.2m in sales in 2023 (90% growth y/y). At the same time, the company estimates they have only penetrated about 9% of the market. The very high list price of Arcalyst enables them to achieve these sales numbers with a relatively small market penetration, but it also puts a cap on their ultimate expansion of the product. Still, Kiniksa expects to achieve $360-380m in 2024 (its third full year of sales) and hopes to reach $500m run rate within 5 years on the market. We see this market as ripe for competition, and just as the evidence backing Arcalyst was embraced by physicians, if CardiolRx™ is proven safe and effective for use in RP patients, we believe it will be embraced as a strong alternative. Cardiol can enter this robust market with a drug that will have broader use and better accessibility to patients, making up the pricing disparity with far greater volume as the drug will have greater reach into the RP patient population who experience less frequent recurrence rates.

The All-Important Phase 2 Pericarditis Trial Readout in Q2 2024 – why we think it will work and drive up the stock price significantly.

MAvERIC-Pilot (NCT05494788) is a Phase 2 open-label pilot study investigating the tolerance, safety, and effect of CardiolRx™ administered to patients with RP. Cardiol completed enrollment of the planned target of 25 patients in February 2024 and will report topline data in Q2-2024.

The second part of the trial consists of 26-week follow-up data and will be shared in the second half of 2024 Q4. This Q2 readout will be a first look at the efficacy of CardiolRx™ in RP over an 8-week period, with measures of improvement using an 11-point NRS (numerical rating scale) from baseline to 8 weeks as the primary outcome. As mentioned above, this pilot trial of 25 patients is the same design as pilot study of Arcalyst, which showed improvement from baseline in the NRS pain scale, as well as CRP reduction, with large effect sizes.12 This makes the NRS pain scale a logical choice as CardiolRx™’s primary endpoint, and a clear reduction in pain and CRP level will provide proof of concept and a clear path to market via a Phase 3 trial. For the MAvERIC-Pilot Phase 2 trial, Cardiol announced that the trial completed patient enrollment on February 21st, and an 8-week primary endpoint takes us to late April and adding about 6-8 weeks for data entry, database lock, and full analysis of the data, we expect to see a data release in the late May to early June timeframe.

We believe there are several reasons to expect a positive read out from Cardiol’s Phase II MAvERIC-Pilot trial. The same Principal Investigator (PI) on the Arcalyst Phase 3 trial at Cleveland Clinic (Dr. Allan Klein) is also study Chairman for the MAvERIC-Pilot trial and runs one of the largest pericardial disease centers in the world and has significant experience in designing and executing clinical studies in pericarditis. It is also clear that he recognizes the promise of CardiolRx™ in this condition. The strong preclinical research showing that the API in CardiolRx™ is a powerful NLRP3 inhibitor underlies our confidence into the MAvERIC readout. Furthermore, the Orphan Drug Designation received by Cardiol was based on the FDA’s review of both pre-clinical and clinical data suggesting that a positive signal in the open label data was already observed by regulators. According to FDA regulations, when applying for ODD in an indication where another drug has already obtained ODD, the company must provide initial clinical data as part of the review package.24 Since Arcalyst already had ODD for pericarditis, it is certain that Cardiol must have provided clinical data from the ongoing MAvERIC-Pilot Trial to the FDA in connection with their positive decision to grant Cardiol the ODD for CardiolRx™. While the FDA’s efficacy standard for this designation is not quite at the level of an NDA marketing approval filing, nonetheless this suggests CardiolRx™ was already showing initial signals of efficacy in the early data. Cardiol has also stated they are already planning a Phase 3 trial, so this speaks to management’s confidence in the readout as well.

ACUTE MYOCARDITIS

A bonus to this story is the acute myocarditis (AM) indication where CardiolRx™ is being tested in its Phase 2 ARCHER trial that has so far exceeded the 50% enrollment mark as announced by the Company on January 9th. This indication has no FDA-approved drugs, and another IL-1 inhibitor called anakinra failed to show benefit over placebo in a large trial, leaving a wide-open opportunity without competition from IL-1 inhibitors. The Company expects to complete enrollment and potentially have data by the end of 2024, which would be the second CardiolRx™ clinical proof of concept dataset this year.

A benefit of this indication is that Cardiol will be able to market the drug to the same group of providers, as same cardiologists treat both pericarditis and myocarditis. In this way, Cardiol would be able to leverage an RP sales force without much additional investment. If approved in RP first, CardiolRx™ would likely see some off-label sales from these providers depending on how the ARCHER trial data turns out, even before an FDA approval in AM. We will delve further into the AM opportunity at a later date, as the most pressing catalyst right now for investors to focus on is the RP data that will be the key value creation inflection point in the near term and will be transformative for the company and stock price.

FUTURE PIPELINE: CRD-38 in HEART FAILURE

Lastly, Cardiol is developing CRD-38, a potential first in class novel subcutaneous formulation of its lead oral drug candidate, for the mass-market indication of heart failure with preserved ejection fraction (HFpEF). Cardiol is developing this formulation to enable lower doses and less frequent dosing while maintaining therapeutic concentrations in the heart. In a preclinical model of HF, the company found positive results with CRD-38. HF in general and HFpEF in particular, represents a mass market indication for Cardiol that has already supported multiple blockbuster drugs and yet chronic HFpEF continues to have significant unmet needs. CRD-38 is currently undergoing IND-enabling studies, so we will explore this opportunity further once the drug is ready to enter clinical development, which we anticipate in late 2024. If CRD-38 shows early promise in patients with HFpEF, the potential upside is too massive to estimate at this point.

CONCLUSION

CardiolRx™ has many things going in its favor headed into a critical Phase 2 trial readout in RP in the May-June timeframe that we think will lead to a positive outcome. This includes a strong rationale for its mechanism of action as well as receipt of ODD which suggests a positive signal in an early data subset, plus a tried-and-true RP trial design with experienced investigators at the helm. Given our expectation of positive data, this leads to what we see as an exciting opportunity given the potential advantages of CardiolRx™ over the competition in this space. With an FDA regulatory precedent for very rapid development timeline clearly established, a robust market for innovation in this indication as evidenced by a successful recent drug launch, and ODD granted to ensure a market exclusivity period of at least 7 years, the value of this Phase 2 proof of concept data will be enormous for the company. At a current market cap of US $118m, this is clearly underappreciated and unrecognized by the market at the present time. For reference, Kiniksa now has a US $1.4 billion market cap on expected sales of US $360-$380m with single to low double-digit market penetration, and we note the example of Jazz buying out GW-Pharma (GWPH) for approximately US $7 billion after Epidiolex reached half a billion in sales in epilepsy over 2 years (now guiding for a US $1-billion-dollar franchise in the years to come). Needless to say, a US $100 million market cap does not do Cardiol justice. With positive data in Q2, the path to market becomes a fait accompli and a slam dunk, and the stock should surge to the upside in response. Cardiol is a strong buy now and after the positive data as the market will come to recognize the significance of the readout after the fact leading to a revaluation and accumulation of shares by funds currently on the sidelines.

TECHNICAL ANALYSIS

In a challenging year for the biotech sector marked by the XBI consistently printing a new lows, the broader market surged, reflected in indices such as SPY and QQQ repeatedly hitting new 52-week highs. External factors like a high-interest-rate environment posed significant hurdles for microcap biotech firms seeking capital or approaching major pharmaceutical companies for partnership deals. Like many other small cap biotech companies, Cardiol has suffered from a deep downtrend. It has traded in a tight horizontal channel between US $0.75 and $1.00 for a nearly 6-month period. This period is called a consolidation period, where the bulls accumulate at any dip and wait patiently for any sign of breakout. This breakout started in early January 2024, moving the price towards US $1.43, followed by some profit-taking and then another jump in the share price the same day Cardiol released the news about the Orphan Drug Designation granted by the FDA. This was followed by the full enrollment in the RP Phase 2 study, moving the price to the high of US $2.17

These days, the price is trading at the Fibonacci-50% area and giving investors a chance to add to their position, or a chance for new investors to start building a position, any price between US $1.48 and $2.08 is good pick, heading into the important catalyst in the May-June timeframe.

As we are getting closer to the RP data release, the price will continue to move upward with positive momentum, the first price target would be the last high US $2.17 followed by the next weekly resistance line US $2.76 and the open gap to be filled at US $3.31. But I won’t be surprised to see the price breaking out the 3-years high at US $4.96 if the recurrent-pericarditis data show a clear success and open the path to move to the next stage with Phase-3 trial, which adds to the company market valuation.

RISK CONSIDERATION

Like any other biotech venture, there is risk associated with clinical trials, and Cardiol shares a similar risk profile. If the MAvERIC-Pilot study fails, the share price will be under extreme pressure, and Cardiol will rely on the next trial in acute-myocarditis to recover. Therefore, exercising caution and conducting thorough due diligence are imperative when considering investments of this nature.

Disclosure: The author is long CRDL in the US & Canada markets.

REFERENCES

- Mayo Clinic. 2024. “Pericarditis: Symptoms and Causes.” Available at: https://www.mayoclinic.org/diseases-conditions/pericarditis/symptoms-causes/syc-20352510

- Snyder M, Bepko J, White M: Acute Pericarditis: Diagnosis and Management, Available at: https://www.aafp.org/pubs/afp/issues/2014/0401/p553.html

- Mauro AG, Bonaventura A, Vecchié A, et al. The Role of NLRP3 Inflammasome in Pericarditis: Potential for Therapeutic Approaches. JACC Basic Transl Sci 2021; 6: 137-150.

- Toldo S, Abbate A. The NLRP3 inflammasome in acute myocardial infarction. Nat Rev Cardiol 2018; 15: 203-214.

- Hartmann A, Vila-Verde C, Guimarães FS, Joca SR, Lisboa SF. The NLRP3 Inflammasome in Stress Response: Another Target for the Promiscuous Cannabidiol. Curr Neuropharmacol 2023; 21: 284-308.

- Libro R, Scionti D, Diomede F, et al. Cannabidiol Modulates the Immunophenotype and Inhibits the Activation of the Inflammasome in Human Gingival Mesenchymal Stem Cells. Front Physiol 2016; 7: 559.

- Huang Y, Wan T, Pang N, et al. Cannabidiol protects livers against nonalcoholic steatohepatitis induced by high-fat high cholesterol diet via regulating NF-κB and NLRP3 inflammasome pathway. J Cell Physiol 2019; 234: 21224-21234.

- Liu C, Ma H, Slitt AL, Seeram NP. Inhibitory Effect of Cannabidiol on the Activation of NLRP3 Inflammasome Is Associated with Its Modulation of the P2X7 Receptor in Human Monocytes. J Nat Prod 2020; 83: 2025-2029.

- Mayo Clinic. 2024. “Pericarditis: Diagnosis and Treatment.” Available at: https://www.mayoclinic.org/diseases-conditions/pericarditis/diagnosis-treatment/drc-20352514

- Gallo A, Massaro MG, Camilli S, et al. Interleukin-1 Blockers in Recurrent and Acute Pericarditis: State of the Art and Future Directions. Medicina (Kaunas) 2024; 60.

- US Food and Drug Administration. 2021. “FDA approves first treatment for disease that causes recurrent inflammation in sac surrounding heart.” Available at: https://www.fda.gov/drugs/news-events-human-drugs/fda-approves-first-treatment-disease-causes-recurrent-inflammation-sac-surrounding-heart

- Imazio M, Brucato A, Cemin R, et al. Colchicine for recurrent pericarditis (CORP): a randomized trial. Ann Intern Med 2011; 155: 409-414.

- Imazio M, Belli R, Brucato A, et al. Efficacy and safety of colchicine for treatment of multiple recurrences of pericarditis (CORP-2): a multicentre, double-blind, placebo-controlled, randomised trial. Lancet 2014; 383: 2232-2237.

- Misawa T, Takahama M, Kozaki T, et al. Microtubule-driven spatial arrangement of mitochondria promotes activation of the NLRP3 inflammasome. Nat Immunol 2013; 14: 454-460.

- Swanson KV, Deng M, Ting JP. The NLRP3 inflammasome: molecular activation and regulation to therapeutics. Nat Rev Immunol 2019; 19: 477-489.

- Hoffman HM, Mueller JL, Broide DH, Wanderer AA, Kolodner RD. Mutation of a new gene encoding a putative pyrin-like protein causes familial cold autoinflammatory syndrome and Muckle-Wells syndrome. Nat Genet 2001; 29: 301-305.

- Aganna E, Martinon F, Hawkins PN, et al. Association of mutations in the NALP3/CIAS1/PYPAF1 gene with a broad phenotype including recurrent fever, cold sensitivity, sensorineural deafness, and AA amyloidosis. Arthritis Rheum 2002; 46: 2445-2452.

- Aksentijevich I, Nowak M, Mallah M, et al. De novo CIAS1 mutations, cytokine activation, and evidence for genetic heterogeneity in patients with neonatal-onset multisystem inflammatory disease (NOMID): a new member of the expanding family of pyrin-associated autoinflammatory diseases. Arthritis Rheum 2002; 46: 3340-3348.

- Hoffman HM, Throne ML, Amar NJ, et al. Efficacy and safety of rilonacept (interleukin-1 Trap) in patients with cryopyrin-associated periodic syndromes: results from two sequential placebo-controlled studies. Arthritis Rheum 2008; 58: 2443-2452.

- Lin D, Klein A, Cella D, et al. Health-related quality of life in patients with recurrent pericarditis: results from a phase 2 study of rilonacept. BMC Cardiovasc Disord 2021; 21: 201.

- Klein AL, Imazio M, Cremer P, et al. Phase 3 Trial of Interleukin-1 Trap Rilonacept in Recurrent Pericarditis. N Engl J Med 2021; 384: 31-41.

- Sermet S, Li J, Bach A, Crawford RB, Kaminski NE. Cannabidiol selectively modulates interleukin (IL)-1β and IL-6 production in toll-like receptor activated human peripheral blood monocytes. Toxicology 2021; 464: 153016.

- Naya NM, Kelly J, Mezzaroma E, Mauro GA, Hamer A, Bolton J, Krishnamoorthi MK, Youker KA, Bhimaraj A, Abbate A, Toldo S: “Cannabidiol inhibits the mesothelial to mesenchymal transition in experimental pericarditis.” Available at: https://www.cardiolrx.com/wp-content/uploads/2023/11/Cannabidiol-inhibits-the-mesothelial-to-mesenchymal-transition-in-experimental-pericarditis_MPD2023-1.pdf

- US Food and Drug Administration. 2024. “Designating an Orphan Product: Drugs and Biological Products.” Available at: https://www.fda.gov/industry/medical-products-rare-diseases-and-conditions/designating-orphan-product-drugs-and-biological-products