Merck & Co. Inc. (MRK) -NYSE

Many speculation going around the huge drop in MRK’s share price in just one week, dropping from the $60.18 (closing on 10/08) to reach the low of $52.49 today, but bouncing back sharply to trade around the support line $53.44. Some speculation of De-risking as we get closer to the IMPROVE-IT trial results next month despite the overwhelmingly negative expectation, and others speculating of some funds who forced to sell MRK, PFE and other large-cap large positions as they had a large stake in SHPG that dropped after ABBV pulled back the acquiring offer.

Looking at the daily chart, we can see that the Stochastics is already deep in the Over-Sold territories and start turning around. Looking back on the Stochastics action during the past year, we can see a new uptrend whenever managed to bounce back and leaving the over-sold are, the same as we had on March, May and August this year.

It is safer to wait and see the closing today, it is very important to get a close above the $53.44 support line and forming a “Bullish Hammer Candlestick” that might give us a hint of a reversal pattern after the huge drop, and then watching the stochastics breaking out the line of 20 that indicate the Over-Sold territory.

Daily Chart

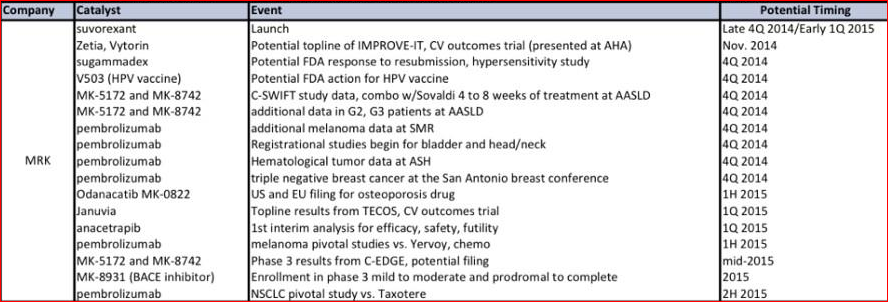

For the long term investors that are looking for the Immuno-Oncology future, it looks like a golden opportunity to add or open a new position, the same for traders who are trading the coming catalysts during the 4Q-2014 and 1Q-2015 . Just know your limits, as adding more Jan’15 Call options that are well behind the AASLD-2014 on November 7-11 and ASH-2014 on December 6-9 .

The MRK events during 4Q 2014 to 2015

Disclosure : Author is long Jan’15 Call Options.

Looks like it closed at $53.43. Close but no cigar?

Yeah, it’s very close to the support line, so will keep watching the price action tomorrow morning